🌊 Where AI Capital Is Consolidating

Where capital flows. How the best build.

👋 Hey, I’m Ivan. I study where capital flows and how top founders build. Today’s Money Flow drop tl;dr:

🌊 The first wave of AI markets has consolidated

🌊 Q2's mega AI rounds: 16 startups raised $31B

🌊 80+ startups became unicorns in H1 2025 (15 in Europe)

🌊 European AI Series A heatmap

🌊 The GTM AI startup wave (YC signals)

🌊 Consumer AI: emotion, memory, and intimacy

🌊 Bonus: Spain’s €10M+ rounds

🌊 Things I’ve enjoyed reading in AI this week

🌊 The first wave of AI markets has consolidated

“You can now name (some of) the winners.” – Elad Gil

What Happened

Elad Gil (invested in 40 unicorns) wrote a great piece on how, after years of noise, the first wave of AI markets has solidified. We now have clear(er) leaders across foundational AI categories.

The Details

Mostly locked-in markets (winners known):

LLMs → OpenAI, Anthropic, Meta, Mistral, Google

Code → Copilot, Cursor, Claude Code, Devin

Legal → Harvey, CaseText

Medical Scribing → Abridge, Ambience

Customer Service → Decagon, Sierra

Search → Perplexity, OpenAI, Google

Markets still forming:

Sales agents

Compliance

Accounting

Security

Agent infra

AI-driven roll-ups

So What

Elad often bets on markets > founders (afaik and researched). With that in mind:

If you’re in a “crystalised” market: build a wedge or GTM advantage.

If you’re in a forming market: now’s the time to claim the category.

Next waves will unlock as models hit new fidelity thresholds (e.g. GPT-5, Claude 3.5).

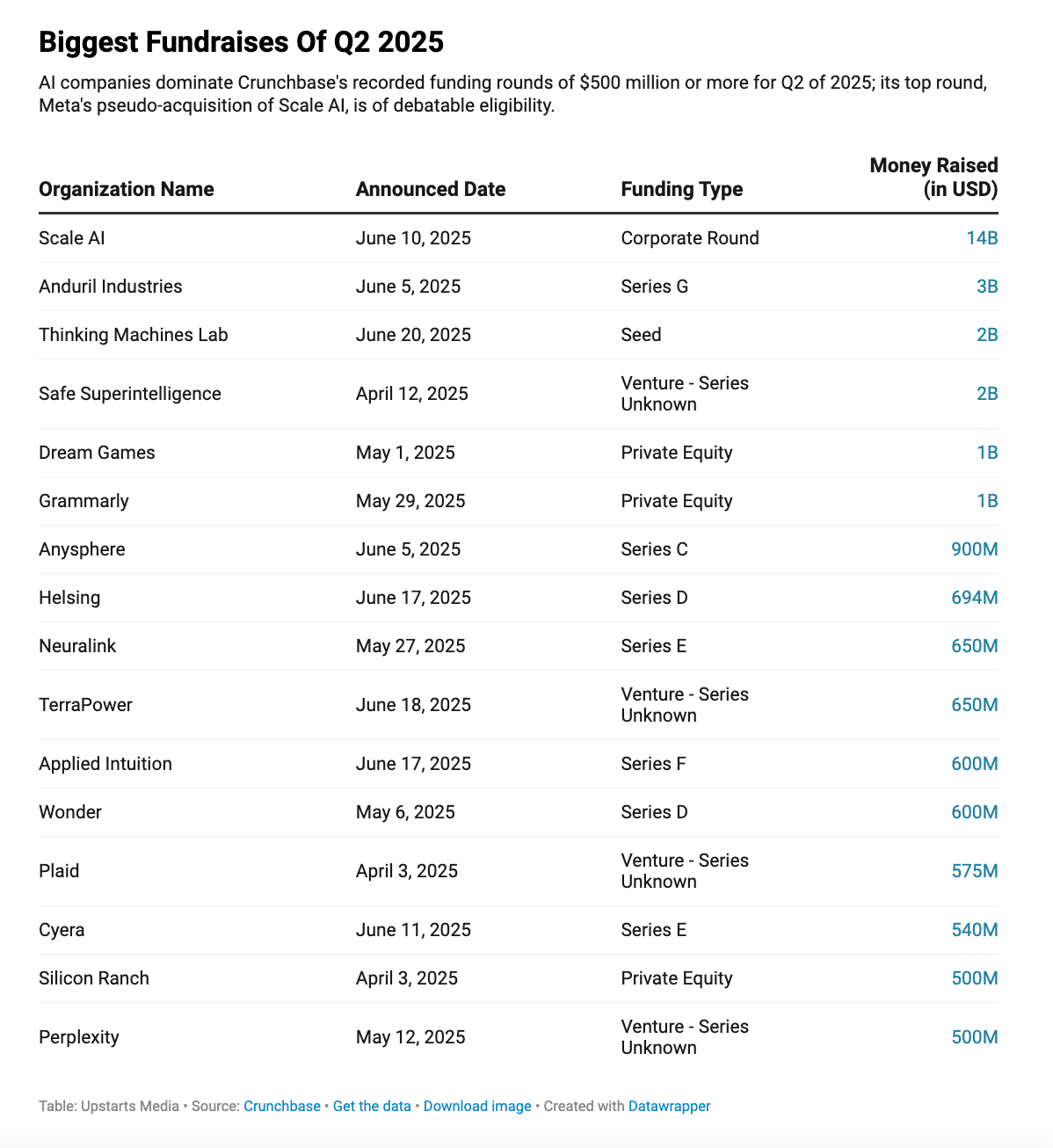

🌊 Q2's Mega AI Rounds: 16 Startups, $31B Raised

What Happened:

In Q2 2025, 16 startups raised $500M+ rounds, totalling over $31B in capital. AI continues to dominate, with 12 of the 16 are AI-native or adjacent.

The Details

Here’s a simplified leaderboard of the biggest raises (credit to Alex Konrad )

So what?

AI is no longer early-stage hype, it’s dominating later stage rounds.

$2B seed rounds (e.g. Thinking Machines Lab) are a signal a new elite tier of “startup.” (or signs of a bubble, or both). We’ve talked about before about how this AI cycle is probably simultaneously over and under-hyped (short-run overrated, medium-term underrated).

Don’t compare your $2M raise to these outliers, these are outliers.

Instead, study what makes them investable at this scale: strategic positioning, infra depth, and geopolitical alignment

🌊 80+ Unicorns in H1 2025 (Europe Holds Its Own)

What Happened

80+ startups became unicorns in H1 2025. 15 of them were European across AI, quantum, defense, and health. It’s still a U.S.-led wave (52 unicorns), but Europe is holding its own, especially in deep tech.

The Details

1) Tide (🇬🇧) – Business banking for SMEs

2) MUBI (🇬🇧) – Global streaming for indie films

3) Oxford Ionics (🇬🇧) – Scalable quantum computing

4) Verdiva Bio (🇬🇧) – Sustainable plant-based meat

5) Isomorphic Labs (🇬🇧) – AI drug discovery

6) PhysicsX (🇬🇧) – AI-powered industrial design

7) Lovable (🇸🇪) – AI platform, build apps without coding

8) Neko Health (🇸🇪) – scanning for preventive healthcare

9) Parloa (🇩🇪) – conversational AI platform

10) Quantum Systems (🇩🇪) – Drones for defense

11) Zama (🇫🇷 / 🇨🇭) – Confidential blockchain protocol

12) Tines (🇮🇪) – No-code security workflows

13) Namirial (🇮🇹) – techn for digital transactions

14) Diagnostyka (🇵🇱) – medical diagnostic laboratory

15) TEKEVER (🇵🇹) – Drones for maritime patrol

The full map:

So what?

Europe’s unicorn playbook is shifting:

AI-native platforms are scaling: Isomorphic, Lovable, PhysicsX

Quantum & deep tech are investable again: Oxford Ionics, Zama

Defense is real: Quantum Systems, Tekever, public sector buyers are back

Healthcare on the rise: Neko, Diagnostyka + surf the aging population wave

🌊 European AI Series A Heatmap

What happened

30 European AI startups raised €10M+ Series A rounds in H1 2025—totalling $957M in capital deployed.

The Details

AppliedAI – AI + Insurance (London) – $55M

Tandem Health – AI + Health (Stockholm) – $50M

Quibim – AI + Biotech (Valencia) – $50M

NexGen Cloud– AI + GPU infra (London) – $45M

Samaya AI – AI + Research tooling (London) – $43M

Bioptimus – AI + Biotech (Paris) – $41M

Latent Labs – AI + Biotech (London) – $40M

Relay – AI + E-commerce (London) – $35M

cartagon.ai – High performance GPUs – $32M

Salience Labs – AI + Chips infra (Oxford) – $30M

Unique – AI + Finance (Zürich) – $30M

Sereact – AI + Robotics (Stuttgart) – $25M

Wordsmith AI – AI + Legal Tech (Edinburgh) – $25M

Maze – AI + Cloud security (London) – $25M

Apheris – Model performance (Berlin) – $20.8M

Synthflow AI – AI + Voice Interfaces (Berlin) – $20M

GetWhy – AI + Research (Copenhagen) – $17M

ecoplanet – Energy Management (Munich) – $16M

Validation Cloud – AI + Web3 Infra (Zug) – $15M

TurinTech AI – Code Optimisation (London) – $15M

Gradient Labs – AI + CS (London) – $11.8M

Aive – AI + Video Automation (Levallois) – $12M

Stotles – AI + Public Sector Sales (London) – $10M

Inven – AI + B2B M&A SaaS (Helsinki) – $11.2M

Yaspa – AI + Fintech (London) – $12M

Jua.ai – AI + Weather Forecasting (Zürich) – $10M

ocell – AI + Climate Intelligence (Munich) – $10M

Flank – AI + Enterprise Governance (Berlin) – $10M

tldraw – AI + Developer Tooling (London) – $10M

So what?

Three shifts stand out:

Vertical AI is dominant: 70% of rounds are in applied sectors like biotech, insurance, infra, and voice.

London is the epicenter: 11 of the 30 rounds are London-based, especially infra and vertical AI tooling.

Biotech & Infra lead in check size: 6 out of the top 10 rounds are in biotech or GPU infra.

🌊 The GTM AI Startup Wave (YC Signals)

What happened:

Over the past 18 months or so we’re seeing a big GTM AI wave forming, best represented by how many of these players are entering Y Combinator in recent batches.

The details:

🔒 *The rest of this edition is for Startup Riders Pro readers only.*