🌊 Liquidity

The 2026 M&A + IPO window.

👋 I’m Ivan. I write about venture capital waves.

This week’s sponsor is LaurenAI by Flippa.

LaurenAI helps you buy online businesses. Tell LaurenAI what you want (SaaS, app, ecom, content site, YouTube + budget). It returns a target list - including businesses not listed for sale, and lets you email owners from one place:

Set your criteria in 60 seconds

Get matched with businesses within your budget

Send personalised messages that actually get replies

Hello there!

Barcelona surfing has been on fire this week with a big swell hitting our coast.

And speaking about swells, in 2025 we finally saw a big wave of $131B in venture capital-backed M&A.

Dealroom shared a great report that helps answers an important question on this:

What is likely to happen to liquidity in 2026?

So as usual, my top 10 key take-aways:

1. Capital came back in 2025, but only for the winners.

The details

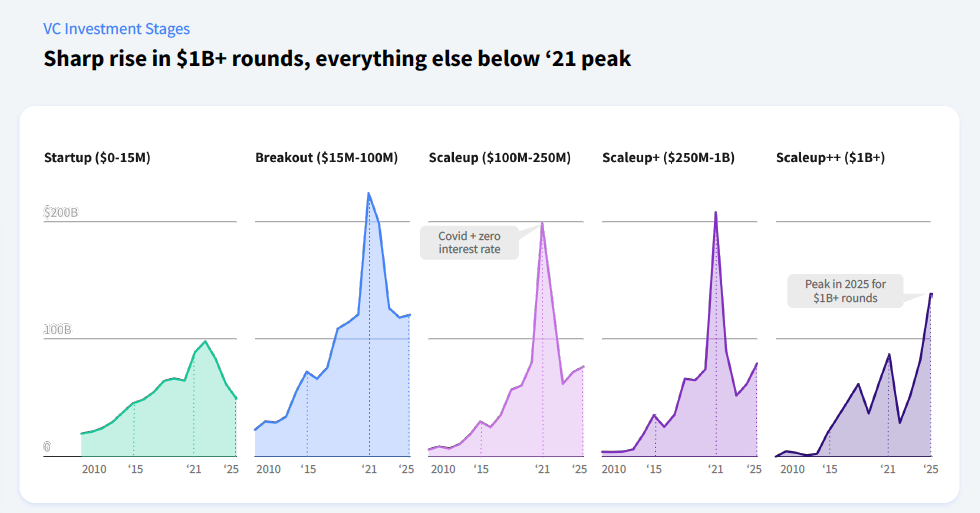

In 2025 we saw venture capital’s usual power law asserting itself a little more violently than usual at the top.

Funding grew about 27 percent and exits reopened (and we have a big queue at the gates of IPO as we’ll cover later), but capital skipped the usual middle phase.

Instead of a gradual re-risking from seed to growth money jumped straight to companies that already looked inevitable (we covered this in point 2 of Systems of Action, where AI investment returns start looking like a barbell, on paper!).

There was a big jump in the number of 1B+ rounds, and a record 18 rounds that were $2B+. Which is obviously dominated by AI infrastructure and frontier model companies (OpenAI, xAI, Anthropic, Safe Superintelligence, Mistral etc.)

We’ve also seen the $100M-revenue companies pulling forward liquidity and optionality, while Series B and C stayed structurally hard.

That is not the normal shape of a recovery. In past cycles capital re-entered more broadly and sorted winners later.

So what

Basically the power law compressed due to both market sentiment AND real market impact generated by many of these companies (wether it persists or not is a different question).

As we discussed previously when talking about “Rivers of Capital”, the market seems to no longer be using capital to discover winners but rather to reinforce the ones it already believes in.

2. Tech is bigger than ever, and a third of it is still private.

The details

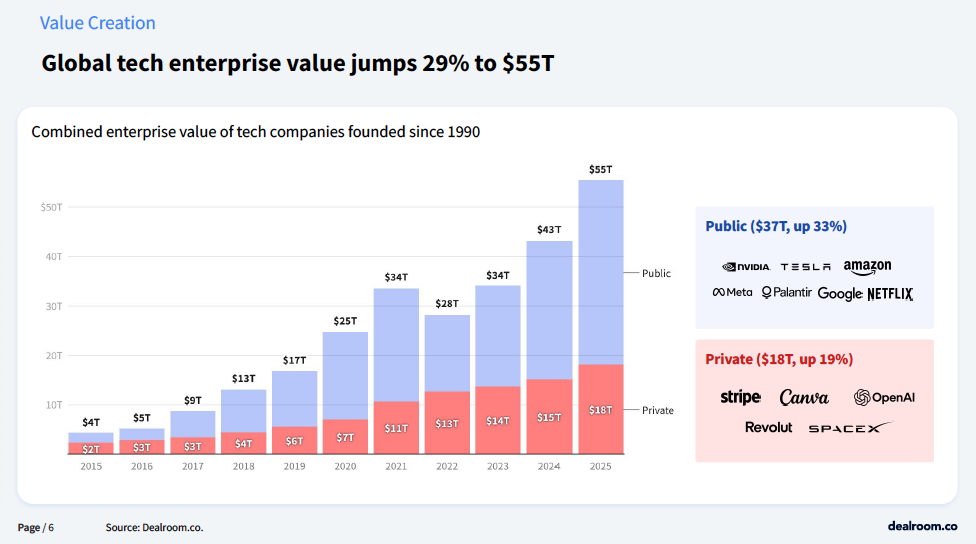

Global tech enterprise value hit $55T, up 30% percent in one year. This should raise some suspicious eyebrows especially considering that $18T is still private.

So what

This is a historical abnormality with an enormous amount of value creation that has happened without public price discovery (and associated concerns).

3. 2026 could be the biggest IPO year since 2021. But only for giants.

The details

The companies lining up for IPOs are already worth $3T+ combined (which means that less than 20% of private value is actually liquid-ready):

SpaceX is the outlier. Internal trades and secondaries price it north of $1T, with Starlink doing most of the heavy lifting.

OpenAI sits in the $830B–$1T range after its latest tender offers. Revenue is real at around $20B but with margins and structure still as open questions.

ByteDance is valued around $480–500B in private markets. The business is ready but likely regulation decides if it ever lists.

Anthropic is now priced at $230–300B in late-stage rounds. One of the fastest valuation ramps ever and gaining ground fast in the enterprise segment (check this out)

Databricks trades privately around $134–160B with strong revenue and enterprise-heavy. Might be the cleanest IPO setup on the board.

Stripe is back in the $90–120B range. Cash flow positive and likely waiting for multiples.

Revolut sits around $75–90B, driven by profitability and global scale. One of the few fintechs markets still like.

Canva is valued at $50–56B with strong profits and simple story. Exactly what public markets reward right now.

So what

What’s really happening is that the IPO window keeps moving later and later in a company’s life. Companies now go public only once most uncertainty is gone which is a shift that worries our friend Bill Gurley (one of my favorite investors) for many reasons.

But one of the most important reasons is that this reflects that public markets no longer fund innovation (or do so less, because they can’t access it early enough due to how much private capital is available) and just validate outcomes already decided in private which can have second-order consequences like founders optimising less for building enduring public companies and more for late-stage private rounds or strategic exits (generalising here, obviously not true across the board).

Which is a change that matters more than whether 2026 has “many IPOs” or not.

4. $100M in revenue is now more important than the unicorn badge.

The details

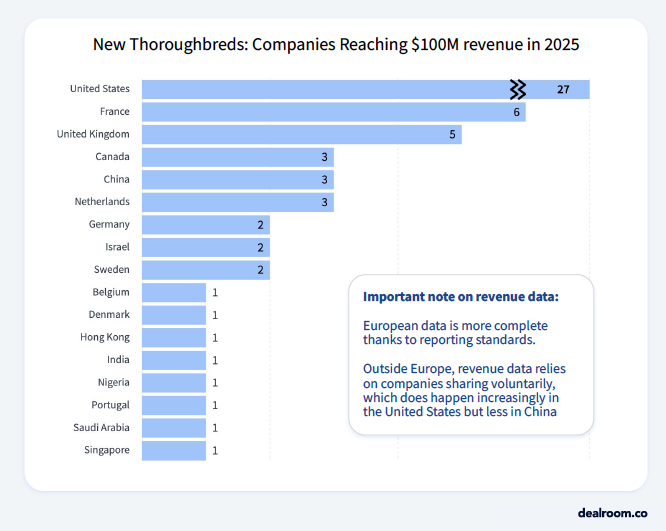

The US produced 27 new $100M-revenue companies in 2025.

Europe looks fragmented country by country. But if you sum Europe, you get roughly 21 new $100M-revenue companies which puts Europe much closer to the US than the chart suggests at first glance. The US creates revenue winners at scale in fewer companies whereas Europe creates them across many countries, sectors, and markets, with smaller individual outcomes but a similar aggregate.

So what

Europe does not have a startup creation problem but a scale and aggregation problem. Talent is there and revenue is showing up but it compounds more slowly because markets, buyers, late-stage capital and access to capital markets are more scarce / fragmented. That matters for exits but it also explains why European companies are more likely to sell earlier often below their technical potential.

But things are moving in the right direction ;).

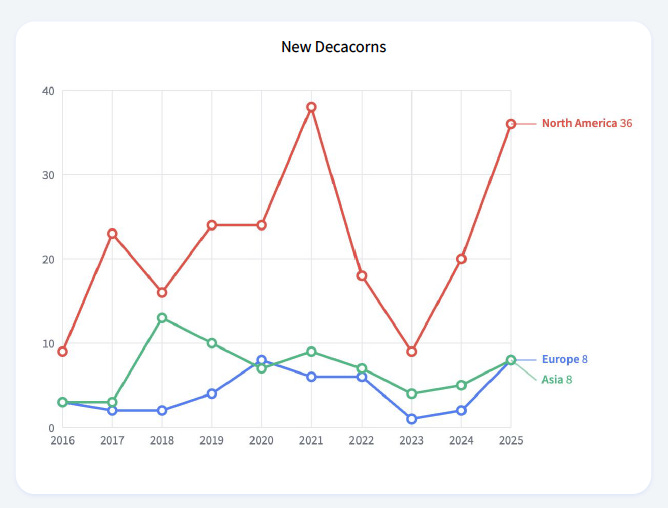

5. Unicorns came back. Decacorns really came back.

The details

This is where North America is the undisputed MVP, producing 36 new decacorns in 2025 whereas Europe and Asia added only 8 each.

So what

Europe is clearly able to create companies that hit escape velocity, and this AI wave is making that happen faster and more often. But the US still compounds those companies into global scale like nowhere else. I’ve written before about ecosystems like Sweden that show what works, and those lessons are probably the most valuable thing Europe can export to itself right now.

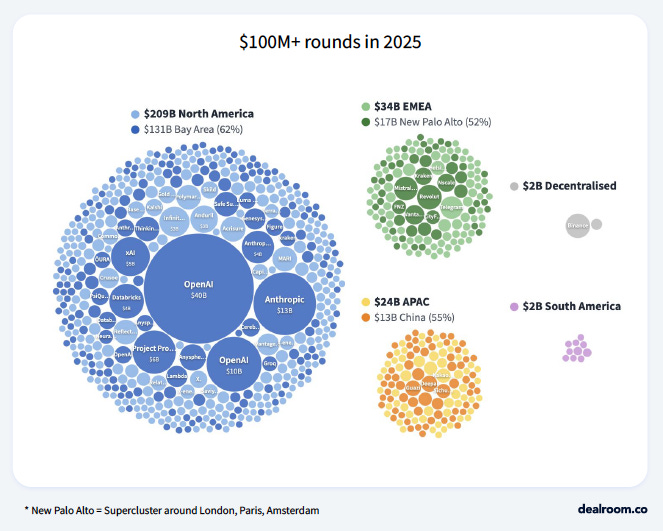

6. The Bay Area captured the AI scale-up cycle

The details

In 2025 Bay Area companies raised $131B in $100M+ rounds, which is more than EMEA ($34B) and Asia Pacific ($24B) combined. Zooming out, 46% of global scale-up capital went to one region (74% went to one country, which is wild).

So what

This tells you where late-stage AI companies end up raising when they need very large checks. When companies crossed into big scale-up territory almost half of global capital landed in the Bay, which means late-stage investors, large buyers, and acquirers are still concentrating risk and ownership there.

7. Capital is flowing into these 5 key areas:

(This is where capital is concentrating, not where experiments are happening.)