🌊 Y Combinator W23

Hello! I’m Ivan from jme.vc. Join >5.5K entrepreneurs learning the best of what other founders have already figured out in under 3 minutes, 1-2x / month

Summary

This week’s good stuff for your startup brain includes:

🌊 Y Combinator — trends in its latest batch.

📈 Spanish Tech IPOs — past, present and future.

💰 Deals - everything you need to know about Spanish dealmaking.

🌊 YC W23

Y Combinator is an accelerator born in 2005 that has built an amazing portfolio of successful startups including Stripe, Airbnb, Dropbox and many others.

They run 2 batches per year (winter/summer). If you get accepted, they offer $125K for 7% of your company, and an additional $375K on an uncapped safe.

IMO terms are great for YC, ok for founders & bad for future business partners - happy to debate, let me know in the comments.

A few things that are often overlooked in their application process:

1. Founders

The most important question - “Please tell us in one or two sentences about something impressive that each founder has built or achieved. It’s not the type of achievement that matters so much as the magnitude.”

My 2 cents: they are looking to assess talent across these traits.

2. Matter of Factness

“Whatever you have to say, give it to us right in the first sentence, in the simplest possible terms.”

“The best answers are the most matter of fact. It’s a mistake to use marketing-speak to make your idea sound more exciting.”

“One good trick for describing a project concisely is to explain it as a variant of something the audience already knows. It’s like Wikipedia, but within an organization. It’s like an answering service, but for email. It’s eBay for jobs.”

My 2 cents: Most worthwhile investors have a pretty developed bullsh*t detector, they’ve heard thousands of pitches and heard all the buzzwords.

They want straightforward answers when they ask you what problem you are solving for. There is a difference between telling them what you solve for and demonstrating how well you understand the problem space.

It might sound counterintuitive - but being direct, brief, reading the room, and having a “how would I tell my grandma what I do” answer to this question will increase your conversion rate.

There is a time and a place to show them how deeply you understand the space you are attacking (incidentally, YC’s next point).

3. Insight

“Just as what we look for in founders is not the type of achievement but the magnitude, what we look for in ideas is not the type of idea but the level of insight you have about it.”

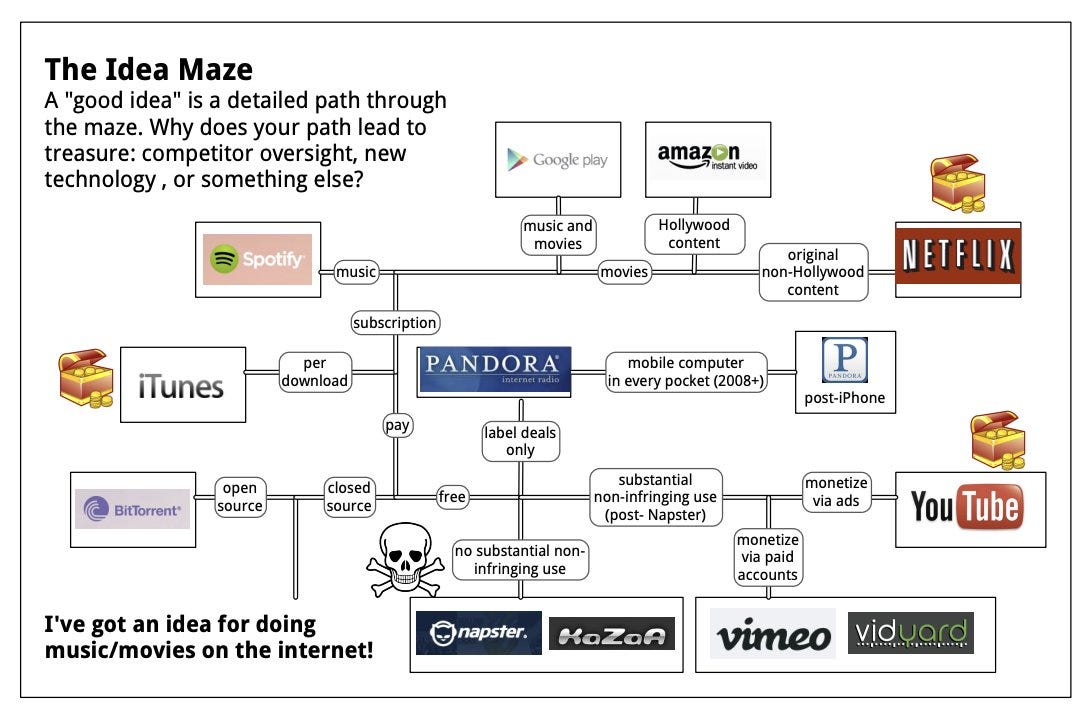

My 2 cents: Here’s where you can go deep, tell them a great story - how you started thinking about the problem space, show them how deep you’ve gone into the idea maze.

Bring them into your story - tell them about the history of this market and the zig and zags of predecessors. Show them you have thought about the pits they’ve fallen into that will help you avoid mistakes. Tell them about the biggest risks in your paths openly. Show them you have thought about technologies and other big currents that are likely to move walls and change your assumptions.

You should be able to demonstrate you have already thought of all of the basic questions around your problem space. This is when sparring, doing many mock pitches with friends and cofounders will help.

I often run into founders not treating fundraising like a sales process - like anything, practice, repetition, ironing out your story and having battle cards ready in your mind are powerful tools.

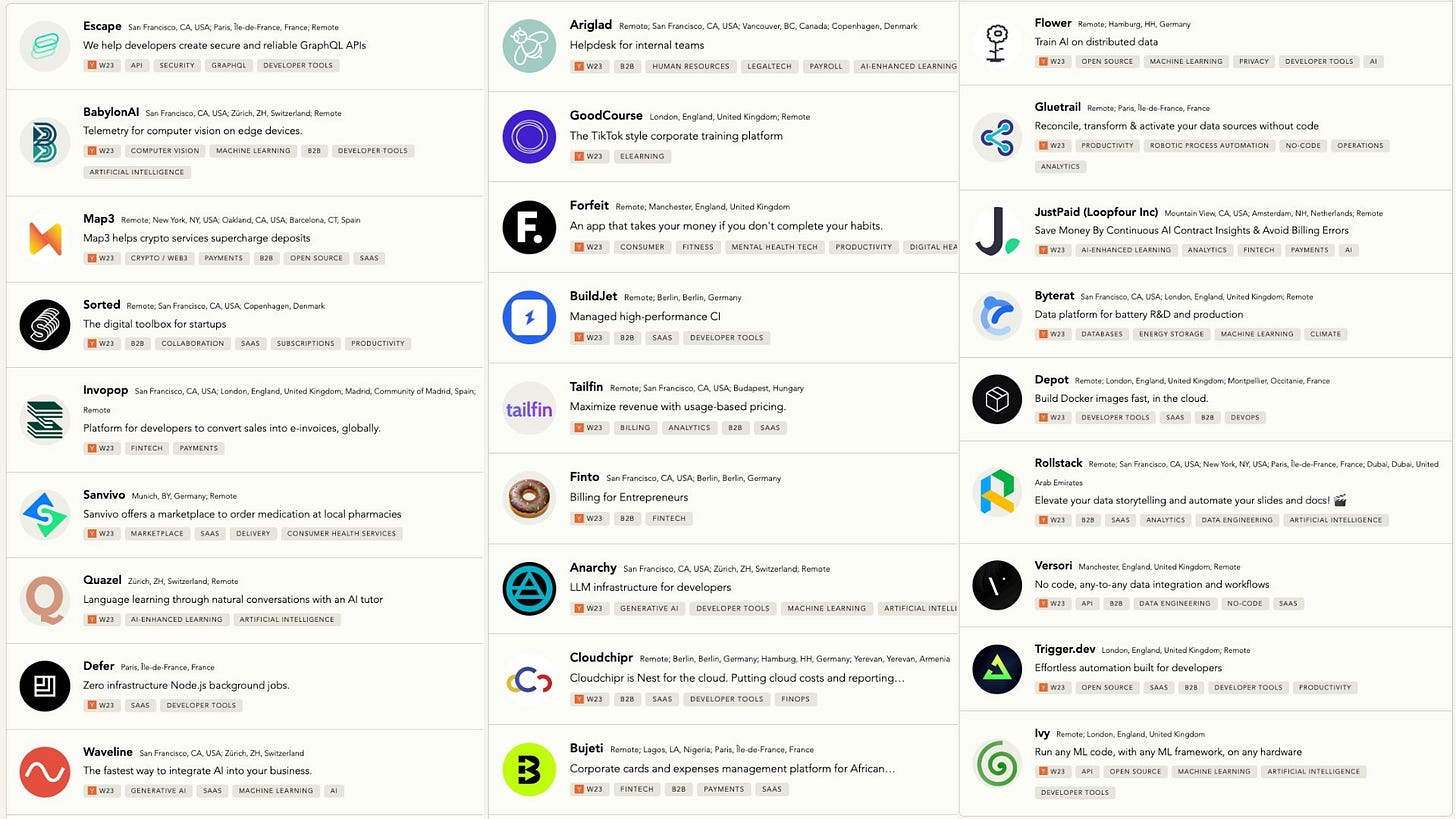

W23 Batch

Even though demo day isn’t until April (data might not be super reliable as 240 have been announced for W23 Vs 232 for S22) - lets take a look at what stands out:

📈 On its way up:

B2B SaaS & Services: represents almost 70% of all startups in this batch, vs 50% in S22. Top 3 categories are:

Engineering, Product & Design: 17% of total

Infrastructure: 8% of total

Sales: 5%, more than doubled vs S22. A few interesting examples:

Paperplane: Automatically turn your sales calls into Salesforce record updates and notes.

BlueBirds: Bluebirds helps outbound teams resell to past customers who switched jobs.

Commonpaper: Common Paper helps you create and sign contracts faster. Build trusted templates using our standard agreements, then negotiate, sign and manage your contracts in a single workflow.

Generative AI: 20% of startups have a generative AI component vs 3% in S22.

📉 On its way down:

Crypto/Web3: 70% decline.

Fintech: 50% decline. 0 insurance startups.

Consumer: 40% decline, only 6% of this batch.

Healthcare: 3% decline.

Education: there is only 1 startup attacking education (surprising), an AI-based language learning tool called Quazel.

European representation: 27 startups (11%) vs 32 in S22 (13%).

📈 Spanish Tech IPOs

We’re hosting a fire-side chat about Spanish Tech IPO’s on March 15th - register here.

We’ll cover:

The history of Spanish tech companies that have gone public.

The reasons why we believe the market will grow.

How the IPO process works.

Advantages and disadvantages of being listed.

The experience of Pablo Martín, CEO of Izertis, and his IPO on the BME Growth.

💰 Deals

You love startups and want to enjoy a Spanish lifestyle? Come join a Spanish startup.

Here’s a list of recently funded startups:

Voicemod (gaming) raised 14M

Build38 (cybersecurity) raised 13M

Opscura (cybersecurity) raised 8.7M

Mlean (manufacturing software) raised 3M

Geodesic (water disinfection) raised 3M

Bloobirds (SaaS) raised 3M

QBeast (Big Data) raised 2.5M

Star Robotics raised 2M

Vitaance (insuretech) raised 2M

Innitius (healthtech) raised 1.8M

Vacka (foodtech) raised 1M

Snab (fintech) raised 1M

Hi

I am currently working on a research project about Recurring Revenue Growth Trends in Spain and I would love to discuss this topic with you. I believe that your insights would be invaluable to my project.

My email: emmanuel.joseph@winningbydesign.com

I look forward to hearing from you soon!