🌊 Web2.5 Tokenomics

Tokenomics, crypto news and startup deals.

Hi! I’m Ivan Landabaso, VC at JME.vc. Join >2.6K entrepreneurs getting smarter about startups. Easily digestible, twice per month. From Spain to the 🌍.

Summary

Gm Startup Riders! This week’s good stuff includes:

🌊 Startup Riders: Tokenomics.

🧱 Crypto Riders: Weekly tl;dr, <1 min.

💵 Deals & Jobs: the best out of Spain.

Investments in crypto-assets are not regulated. They may not be appropriate for retail investors & the full amount invested may be lost.1. Tokenomics 🪙

✅ TL;DR

No time to read the whole thing? Here’s the net net in 3 bullets:

Some Tokenomic factors are often grossly overlooked when assessing web3 projects: 1. Vesting periods / incentive alignment, 2. Exit scenarios.

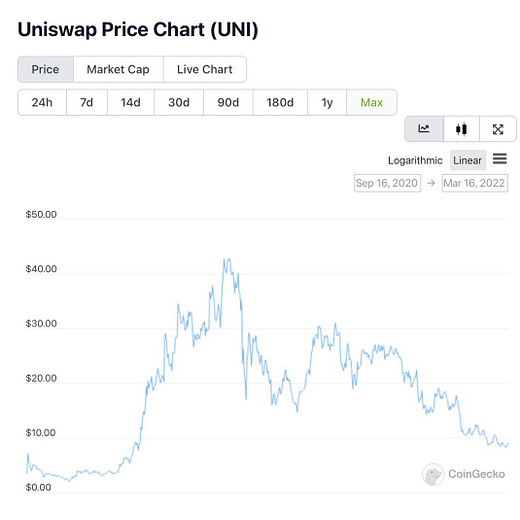

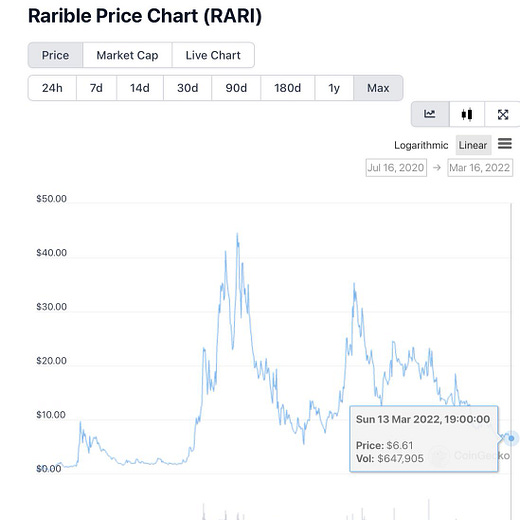

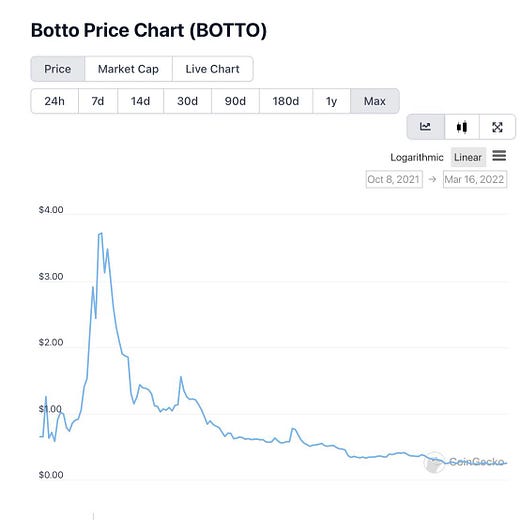

Some projects’ Tokenomics incentivize short-term hedgefund-like behaviour, likely harming long-term value creation. We might look back at 2022 and feel the same way we did back in 2017 with the ICO mania.

We should be more demanding of white papers and project proposals, if we don’t want to hamper web3 innovation in the long-run.

😟 Problem

Broken tokenomics are sometimes overlooked when assessing web3 startups.

🤩 Solution

Too early to tell - perhaps an option would be taking the best of both worlds (tokens and equity, merged and/or adapted), definitely regulated (its coming).

🪙 Toke-what?

Look before, or you’ll find yourself behind.

— Benjamin Franklin

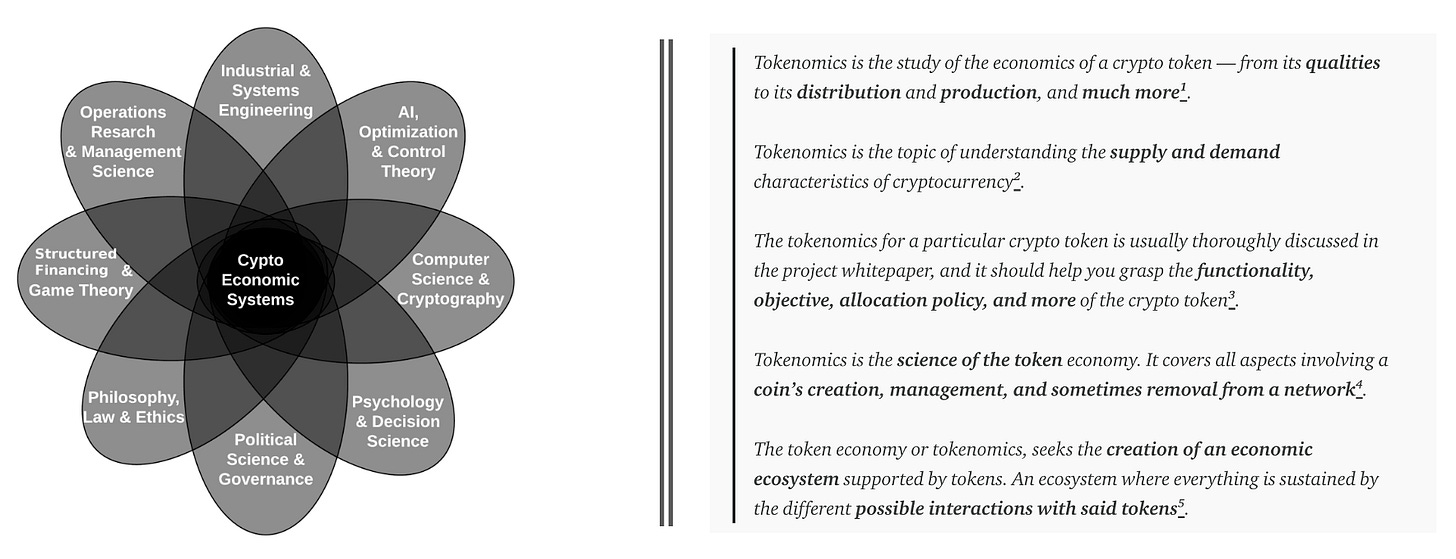

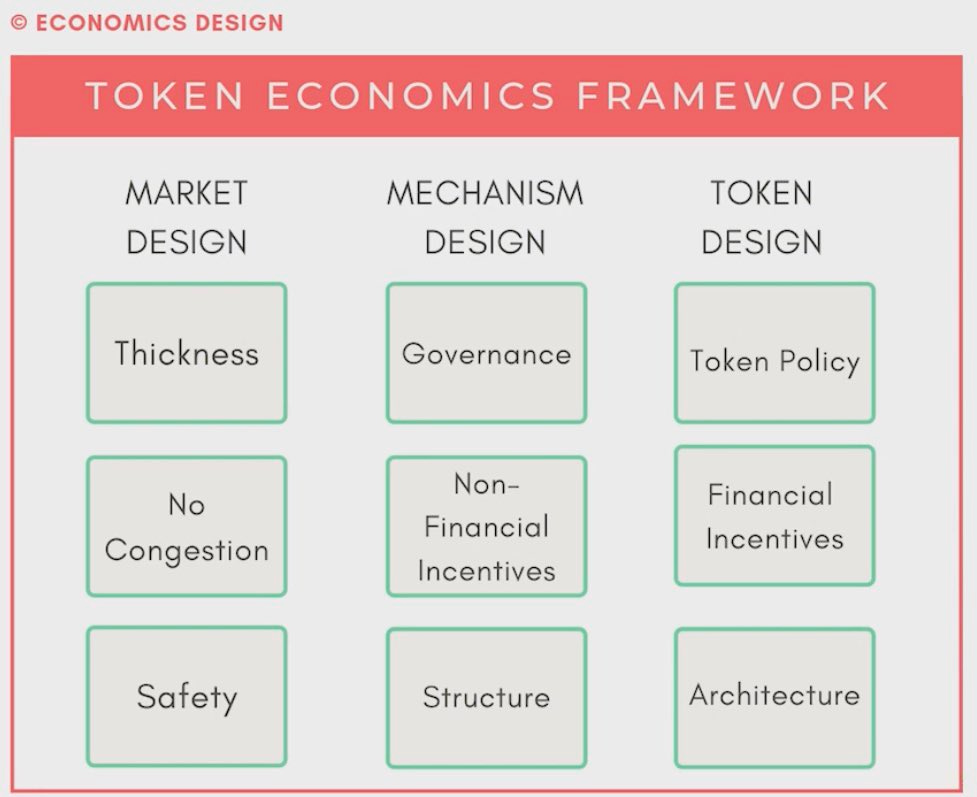

Tokenomics is short for Token Economics. The term encompasses a number of variables including supply, allocation, distribution, emission and utility.

We are so early and there has been so little attention paid to Tokenomics that there really isn’t a single widely accepted definition:

Because Tokenomics are still in their infancy, we should probably cut them some slack. However - it is a problem. Many evaluate web3 projects without diving into or thinking about tokenomics.

There seems to be more emphasis on:

The team: track-record, social media buzz, referrals

PR, branding and community: size and engagement

Business model: robustness and payment mechanisms

Legality: still murky, but progress being made to bring on a solid legal teams

Specifically on Tokenomics:

Token Supply: circulating, maximum and total supply.

Burning Mechanism: how is value retained when supply rises? What mechanisms are in place to address price fluctuations and long-term stability?

Consensus mechanism: what methodology is used to achieve security, trust and agreement.

Earnings Distribution: a key decision-making vector in web3 - refers to how profits are shared with stakeholders - mainly in exchange for incentivizing miners, securing a network and confronting inflation. Famously so far, through: 1. Mining 2. Staking or 3. Running Masternodes.

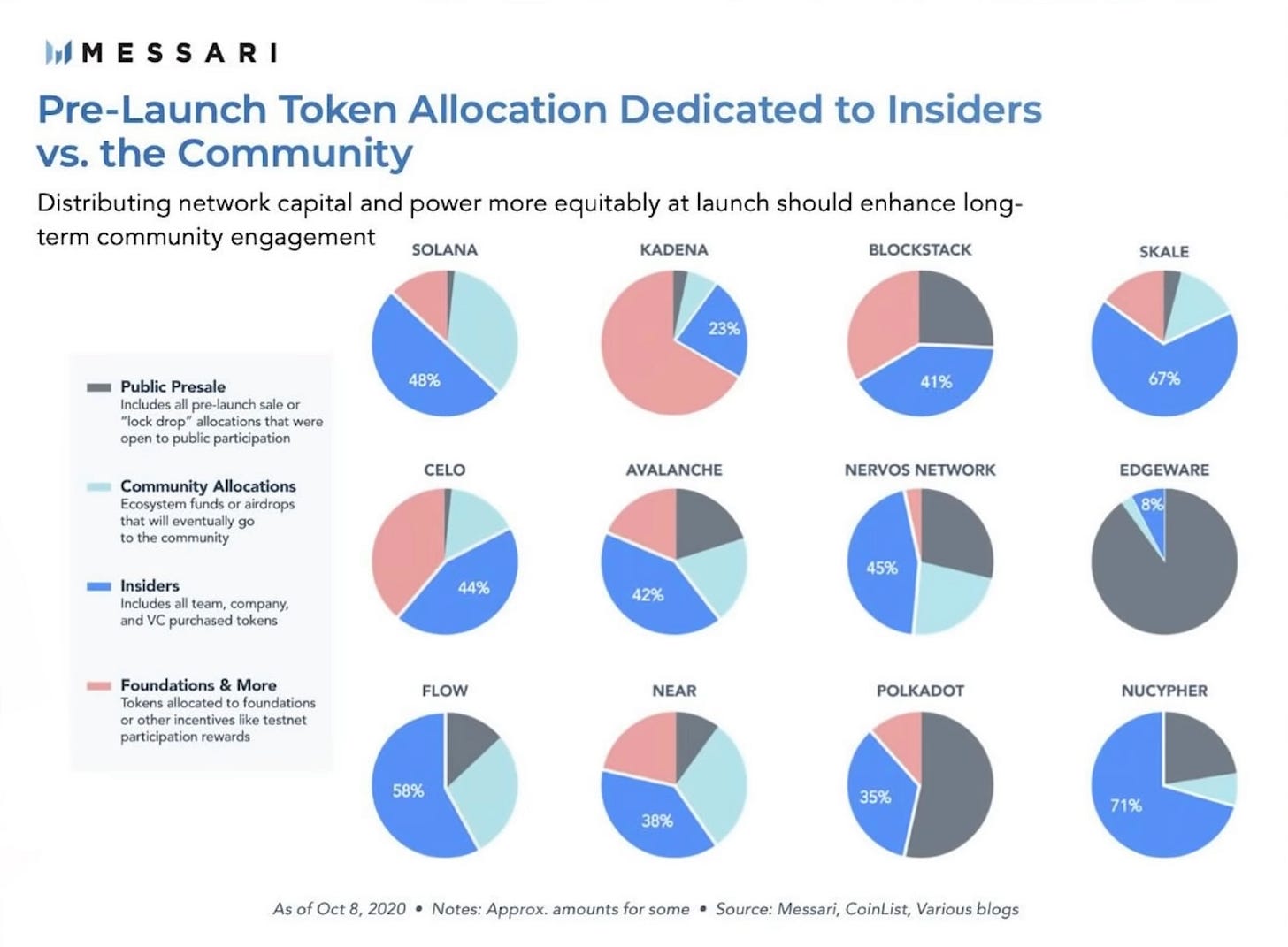

Token Distribution & Governance: Mostly related to ownership, “decentralization” & value capture: how is the ownership pie distributed? what is the size of and how do reward-flows work, and how are decisions made? Is it possible that big wallet sales can manipulate the market?

And yet, relatively speaking, little attention to:

Token Utility: what use-case does it serve within and/or beyond its ecosystem.

Token Structure: technical aspects related to the nature of the token, usually dealt with by throwing a “renown” technical audit at the problem.

Exit Scenarios: what happens in a liquidity event? What part of the dual economies that often live within the project (token & equity) captures value?

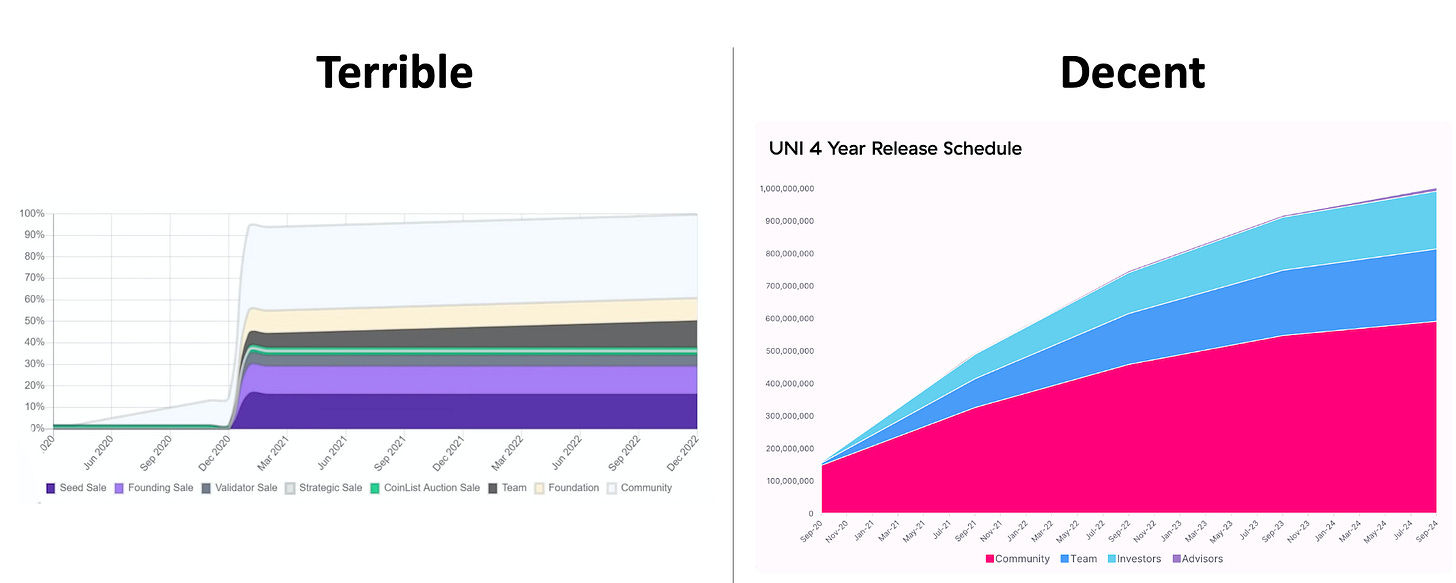

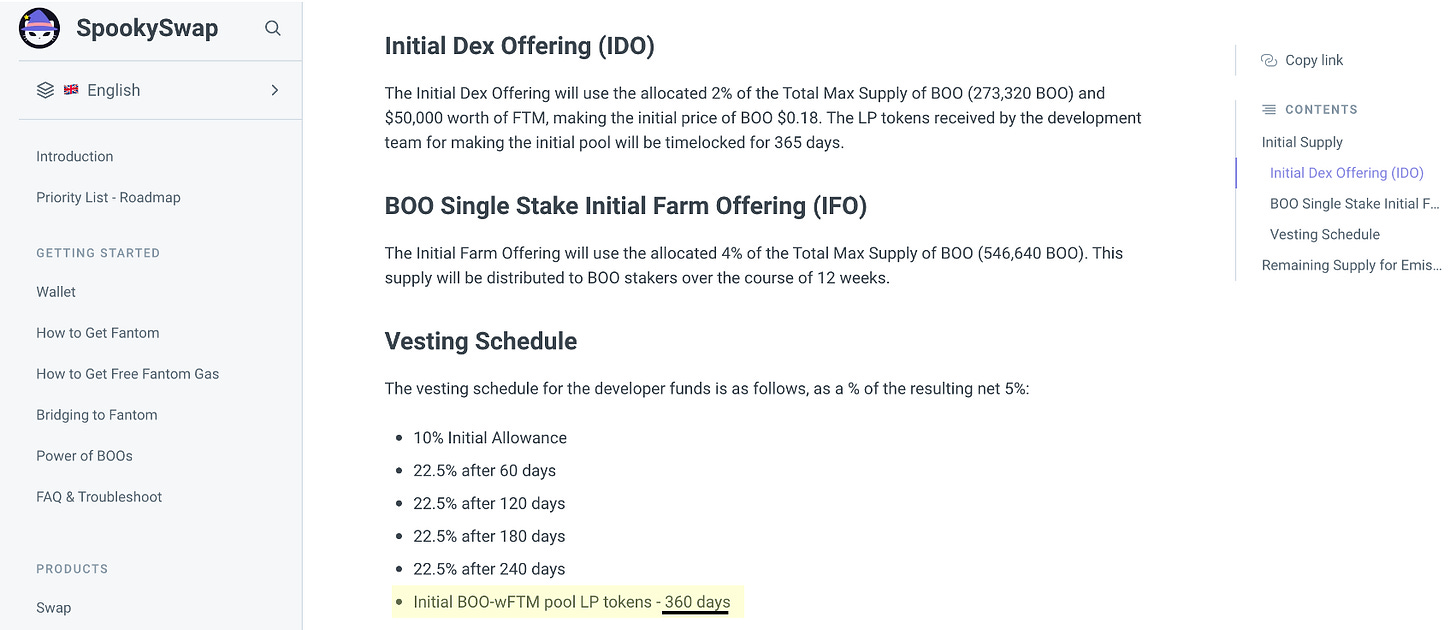

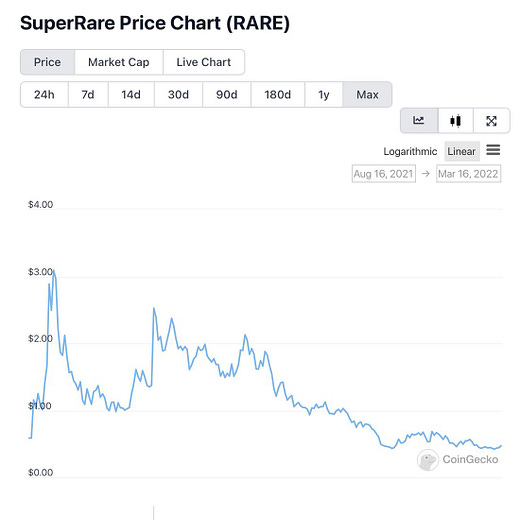

Incentive Trade-offs & Lock-Ups: what trade-offs is the core team making by choosing to pursue one model over another? Unknowingly incentivising pump and dumps? What is the average lock-up period? How does it differ across founders, contributors, private-sale holders etc.? Here’s an example of Terrible Vs decent vesting periods:

These exit scenarios and trade-off questions are usually captured in the “traditional” web2 investment world under term-sheets and shareholder agreements - but I suspect people can very quickly run into problems by overlooking these in web3.

This is likely being worsened by:

Excess liquidity: great to go further on the risk curve, often fuelling innovation - dangerous on the other hand because of potentially broken incentive dynamics (i.e. if people can take more money than they need off the table, they might, regardless of the long-term trade-offs and implications)

Web3 immaturity: we’re likely very early in the game.

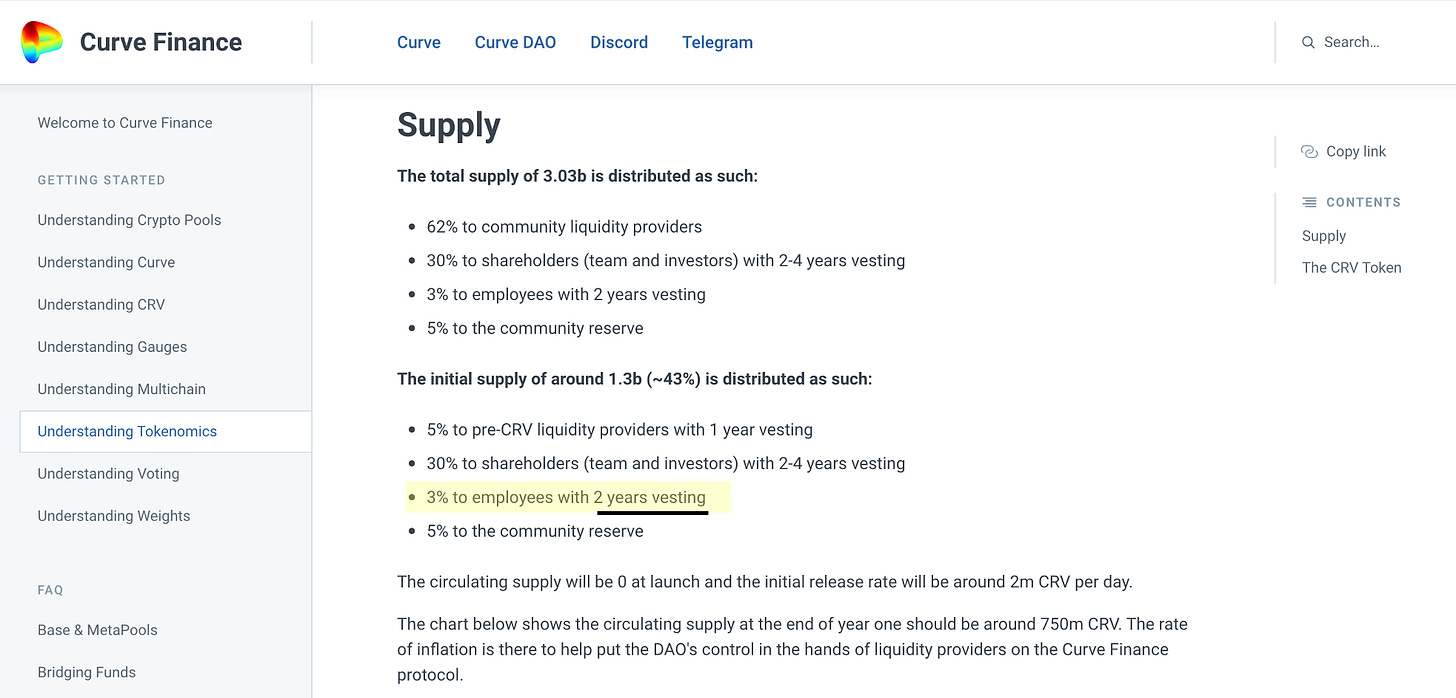

🤔 A few examples

Curve Finance

SpookySwap

Airdrops

I’d love to show you some examples of Tokenomics documentation where exit scenarios are discussed - but I can’t find much 🤷. If you do, let me know 🙏.

⁉️ Important Questions To Ask

If you are either thinking of joining a web3 project or invest in one, I urge you to ask founders very direct questions. There is no shortage of horror stories. Sure, these happen everywhere (not just web3), but imo we should be extra careful in this market.

Some direct questions we should be asking:

Double-economy

Why are investors and contributors accepting the existence of two different economic models in a project, that may or may not be connected? What are the trade-offs? What are the long vs short term implications?

If you decide to invest in equity - should you be getting a proportional stake in equity so as to preserve value capture? If not, what slice of the tokenomic pie should that be and why? The stakeholder, private-sale or other slice? Or should it be the proportional % stake of equity reflected in the total token economy?

Exit Scenarios

What happens in a liquidity event, to both token holders and equity holders Why is this relationship between tokens <> equity not clearly defined and at the front of the conversation when one decides to invest in a web3 startup?

What happens in 5 years when investors are looking to cash-out returns and realize there’s not clear path to do so? What happens if they are invested only in equity, or tokens, and only the non-invested one has captured value?

Price Sensitivity

What do you think happens to the price-per-share of a company when a “big” investor decides to sell their stake? Now, what do you think happens if equivalently a “whale” sells its token stake all at once - shouldn’t this trade-off be considered when evaluating a double-economic model?

Incentives & Trade-offs

How are you thinking about the trade-offs between raising too much money and/or too little? What is your reasoning for raising more or less money? What exactly are you going to dedicate these funds to?

To what extent does this token lock-up - notice, often “weaker” than the traditional 4 year vesting period in equity - fuel speculation and lack of alignment with retail and professional investors + contributors?

Why are we assuming token lock-up periods for founders are the same as equity lock-ups (they are not, tokens can be way more liquid)?

Irrational Exuberance

Why are people often accepting enormous fully-diluted crypto valuations with projects that barely have a functioning product? Why are people normalizing a total disconnect (with some notable exceptions) between value produced in the real world and these market caps?

Are we replicating 2017’s ICO mania with broken tokenomics 2022?

This is an area were I have many, many more questions than answers - so if you have a solid perspective on any of the questions above, please comment below!👇

👀 What to watch-out for:

Rampant speculation and hedge-fund-like behaviour: power dynamics leading to excessive capital being raised on the token side, which in turn tend to incentivize hedge-fund-like activity (short-term gains) - instead of long-term partnership and value creation.

Lack of incentive alignement: Trade-offs being made due to the easiness / FOMO of not letting money on the table translates into trading short-term gains for long-term pains - not only with investors, but also aligning the team / contributors’ incentive to pursue long-term value creation.

Half-baked whitepapers: Many projects are raising millions with a half-backed whitepaper and an MVP - taking two bites at the cherry.

Possibly bad for long-term web3 reputation: when the market dries up (and it will), and people realise they’ve been investing in dual-economies with unclear exit strategies, it could backfire + slow down innovation in web3. We should explore what a healthy middle-ground looks like.

🪛 Useful Tools

🐇 Follow the White Rabbit 🕳️

2. Web3 Riders 🧱

Weekly crypto summary in <1 min:

3. Deals 💵

You love startups and want to enjoy a Spanish lifestyle? Come join the Spanish startup ecosystem. Here’s a list of recently funded startups:

I’m looking for the best sales leaders in Spain looking to join a community. If you know that person send them this link and DM me please 🙏.

What'd you think of today's email?

Thank you and see you next time! 🤙