🌊 Tokenizing Retail

Welcome! I’m Ivan Landabaso, VC at JME.vc. Join 1.8K+ entrepreneurs discovering new tech waves, startup trends & leverage bi-weekly (+ surfing 🤙)

Summary

🌊 Wave: Tokenizing Retail - Web3 Brands.

🦾 Leverage: Use your phone, don't let it use you.

🇪🇸 Deals: Seedtag, Genially, Housfy, and more!

Tokenizing Retail: Web3 Brands 🛍️

This week we are learning all about the future of Web3 Brands from two amazing retail brand-building CEOs who have skin in the game and went deep down the 🐇🕳️.

If you’re interested in the space, I highly recommend you follow their work:

Diego Arroyo from Laagam - epic on-demand fashion.

Javier Jimenez from Tot-Em - super-personalized jewelery.

Lets go 👇

😟 Problem

All retail gurus claim the obvious: build communities, branding is the ultimate monopoly and you should focus on organic reach through earned media. Easier said than done, no article gives an actionable plan to brand-building.

Most legacy players don’t have the capabilities and most Digital Native Brands don’t have the funds to acquire thriving newsletters with millions of subs, to start a viral podcast (spoiler: we try at laagam) or the organic access (plus some luck) of being featured by celebrities.

The returns for these kinds of efforts are both hard to measure and take a long time to mature, the leap of faith needed to fund these initiatives is hard to stomach. Time is something cash-strapped businesses like most retailers don’t have.

So the easiest and safest path to revenues has traditionally been performance marketing. As the old joke says “nobody gets fired for spending on Facebook Ads”.

But if this is your only strategy, it will only take you up to a point. Then the law of diminishing returns quickly kicks in.

🤩 Solution

So if spending on performance is a ‘laugh now, cry later' strategy and brand building for long term growth is more an art than a science, what can niche brands with fan clients and legacy brands with huge databases do now? Let me be a guru: build community powered brands.

Make your current users your growth engine, they already love your brand and probably sell it better than you. This has been the logic of the archetypical referral program “get one friend in and enjoy -15% on next purchase”.

But this is a short sighted strategy, based on a transactional relationship difficult to transform into a growth engine. If you want your clients to be emotionally invested in your brand, share an upside with them: privileges, access and/or liquid assets.

Here is when the acronym of the moment steps in: NFTs. Or how this specific use case is named: brand coins (or social tokens):

An instrument to align interests: the more you grow, the more valuable your brandcoin will be, the more effort will put your community in helping you achieve that growth.

⏳ How we got here

CAC is the new rent.

The idea of social web where as a brand you could access and interact directly with your community has proven false. Most audiences hide behind algorithms and you need to pay a ransom to their lords: mainly Facebook, Google and now TikTok.

The direct to consumer relationship has more into pay-per-access, you now have to pay rent for having a digital storefront on web2. Thus a good chunk of venture capital dollars seem to land on paying this new digital rent.

“Advertising spend in tech has become an arms race: fresh tactics go stale in months, and customer acquisition costs keep rising. Such is the world of user acquisition in tech today: as growth becomes increasingly expensive, somebody must be footing the bill for all of this wasteful spending. But whom? It’s not who you think, and the dynamics we’ve entered is, in many ways, creating a dangerous, high stakes Ponzi scheme”

- Chamath Palihapitiya

This tendency has been exacerbated by the new iOS 14 adpocalypse. Targeting consumers, even the ones you already own, is getting harder and more expensive. Lots of brands are on the brink of bankruptcy because they were never able to develop high flying branding and thus need ads to sell. Which is how most SME companies have always marketed themselves, differential branding works only for the lucky few .

So if social web (or web2) is not delivering on its promises, if the internet is getting more centralized than ever, what can incumbents do?

Embrace web3, embrace the blockchain as means to arrive at the end customer.

Because behind all the FOMO, all the clickbait and all the weird avatars pics on social media, crypto is the largest force of change in the last 20 years. Through tokenization, which is no more than immutable and programmable property rights, the distribution of ownership and socialization of upside can help brands turn their actual client base into the most powerful advocacy force: a true salesforce.

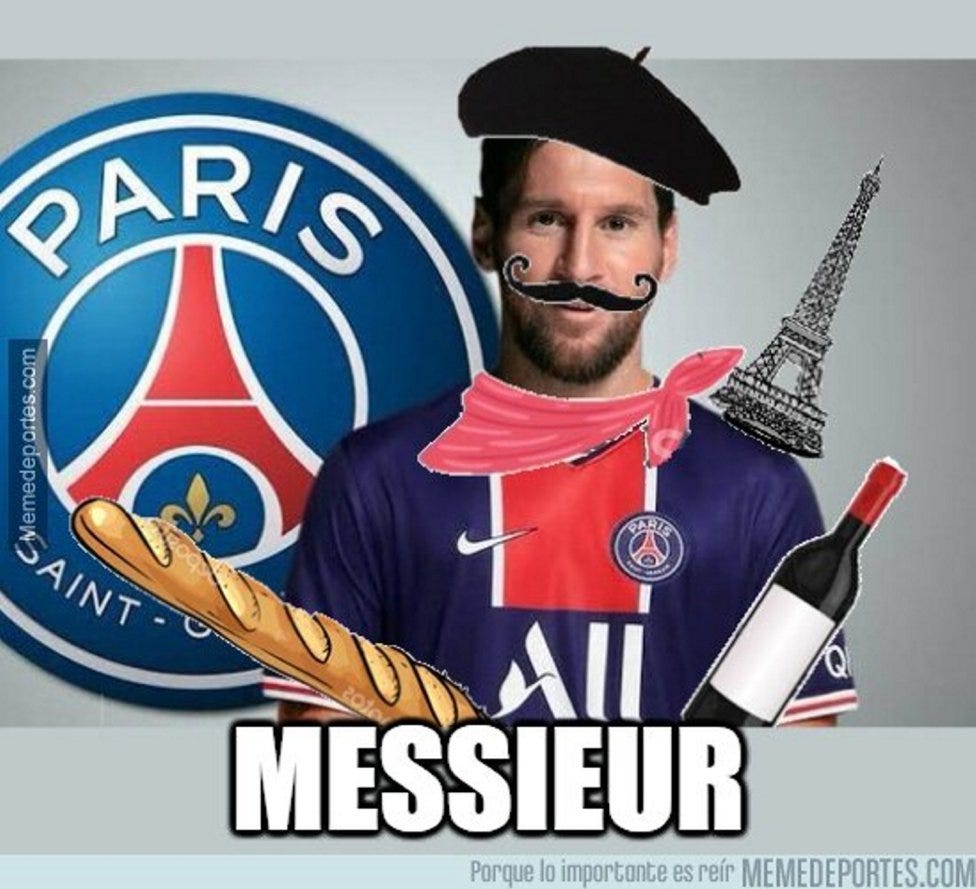

Some of the first brands to embrace this change have been football teams through their Fan Tokens. By partnering with socios.com they have been able to give preferential access to decision making for a more engaged community. But also found a financial tool correlating with their success on the pitch and a new revenue stream: FC Barcelona got €1.6Mn by floating their tokens, which are down -37% since Messi left…

We find companies like Rappi which are tokenizing their loyalty programs, so their best customers can turn their illiquid loyalty points into a monetizable asset: around $100Bn in loyalty points remain unclaimed.

“You earn tokens for investment, participation, or work and they give you upside, privileges, votes, or a combination of all three. Tokens sound lighter than shares, less serious, but in reality, they can be much more powerful.

By compensating users for positive participation, Web3 projects (brands) can build up energy that might become strong enough to carry them from the early niche to the mainstream.”

Individuals are going to hold only the tokens of the brands that deeply align with their values. In exchange, they will get perks and benefits but also a massive ROI as the brand grows.

Social tokens will be an honest definition of the individual. Because now they are putting their money where their mouth is.

The brands that find a way to “actually pay people to use the product, in a currency that gets more valuable as more people join” will find a gold mine of growth.

Because Web3 allows us to create money out of Money out of thin air, the closest we ever had to alchemy. By paying out people in your brandcoins for doing things that are beneficial to the brand is in my opinion the next frontier of retail. We at laagam and Tot-em still don’t know how, but we want to find a way.

👌 Hacks

Experiment with one of these toys in a closed MVP environment:

Web3 marketing is about brands working to generate value with consumers, not extracting value from them. Think in terms of a positive sum game.

You shouldn’t go full crypto if you don’t feel like it, there are steps in this stairway to heaven: from creating digital collectible memorabilia, to partnering with established metaverses like Roblox or Fortnite and up to generating full 3D virtual goods.

🐇 Follow the White Rabbit 🕳️

🦾 Use Your Phone, The Right Way

💵 Recent Deals In Spain

You love startups and want to enjoy a Spanish lifestyle? Come join the Spanish startup ecosystem. Here’s a list of recently funded startups:

Seedtag (contextual ads) raised 34M

Genially (SaaS interactive content) raised 14M

Housfy (Proptech) raised 10M

Ukio (proptech) raised 7M

Frenetic (magnetics SaaS) raised 4.5M

Seqera Labs (science saas) raised 4.5M

Gamestry (gaming) raised 4.2M

GuruCall (marketplace) raised 1.2M

ScrapAd (marketplace) raised 1M

Rand (DeFi) raised 800K

Frontwave imaging (breast cancer imaging) raised 750K

Celtary Research (science) raised 650K

Pulpo (subscription sharing) raised 550K

Tradeasy (trading) raised 280K

Tugesto (Iegal) raised 250K

Bersity (education) raised 240K

Yakk (marketplace) raised 240K

RawData (agriculture tech) raised 200K

Muy buena ivan! 👏🏻