🌊 The New Rules of Raising

What founders can learn from April’s capital flow, why the AI stack is shifting, and how not to break your cap table

👋 Hey! I’m Ivan. I break down ideas and research from the top 1% of founders and VCs—so you can surf trends, build smarter, and raise better.

Join 20K+ Startup Riders surfing tech waves:

Founder Briefing

🌊 RAISE

→ Where AI seed capital went in April (22 EU deals decoded)

→ How to raise in a barbell market (Redpoint data)

→ What $5B+ startups looked like at Series A

🌊 START

→ How to hire (or be) high-agency talent

→ Why Theory of Change beats Theory of Action

🌊 GROW

→ 80/20 guide to useful startup boards

→ Macro shifts founders can’t afford to ignore

+ Iberian Dealflow: 20+ Spain-based startups raised in April

This newsletter is proudly sponsored by Yellow Birds Creative.

Creating organic content for your socials is tough. It's even tougher to do so in a way that accurately reflects your brand identity. We offer 3 packs:

Content creation: photography, video, video podcasting, copywriting.

Social Media Management: taking care of all your content needs.

Project Management: ideate, plan, and manage marketing initiatives.

🤝 Partner with Startup Riders: Learn about sponsoring

🌊 Where EU AI Seed Capital Is Flowing (April-25)

What Happened

I looked at 22+ AI startups that raised Seed rounds across Europe last month. I did a fast breakdown of the data—and a few key trends stood out.

The Details

Avg. seed round: $3.83M | Median: $2.84M

Median valuation (20% dilution): ~$14M

Infra plays emerging: 5 companies are building enablers, not end-user apps

No winner vertical: Health, fintech, legal, HR all represented—but no breakout

Investor landscape: No dominant leads; mostly micro-funds or early-stage specialists

Geography: 🇬🇧 UK: 26% of rounds, 🇫🇷 France: 21%, 🇩🇪 Germany & 🇪🇸 Spain . No single European hub is winning—AI innovation is diffusing

Likely seeing a strategic broadening of the AI stack. Founders are building infrastructure, not just “AI-for-X” clones. Few consumer apps. Mostly tools, enablers, and agentic primitives.

Here’s the list:

Emmi AI (AI physics architecture) raised $17M

Qevlar AI (autonomous security) raised $10M

pyannoteAI (Dev speaker intelligence) raised $8M

Diagnoly (Health AI) raised $6M

REMATIQ (AI Compliance) raised $5M

Portia AI (Agentic frameworks) raised $5M

Mindset AI (Agent PaaS) raised $5M

TaxDown (AI assisted tax) raised $5M

Capably AI (AI Automation) raised $4M

Harmonix (AI CRM) raised $3M

Zeno AI (AI legal) raised $2,3M

TaxZap (AI tax reporting) raised $2M

Delos (AI workspace) raised $2M

CleanMob (telematics) raised $1.4M

Kardi Ai (AI for health) raised $1.2M

boby.ai (AI apps) raised $1.2M

Assiduous (AI fintech) raised $1.1M

Etiq AI (data science copilot) raised $1M

Foliume (AI insurance) raised $1M

Kalent (AI recruiter) raised $1M

Spotlight Pathology (Medical AI) raised $500K

SUBJCT (Automated linking) raise undisclosed.

So What?

If you’re building or raising in AI, here’s what to learn from these rounds:

There’s opportunity to be early in a new stack layer

Don’t just “add AI” to a category, own the wedge

Specialist funds are writing checks, find your thesis-aligned micro-VC

You don’t need to be in London or Paris, but you do need sharp narrative + team signal

I’m actively investing in infra, agents, and early AI primitives. If you’re building something with leverage—DM me.

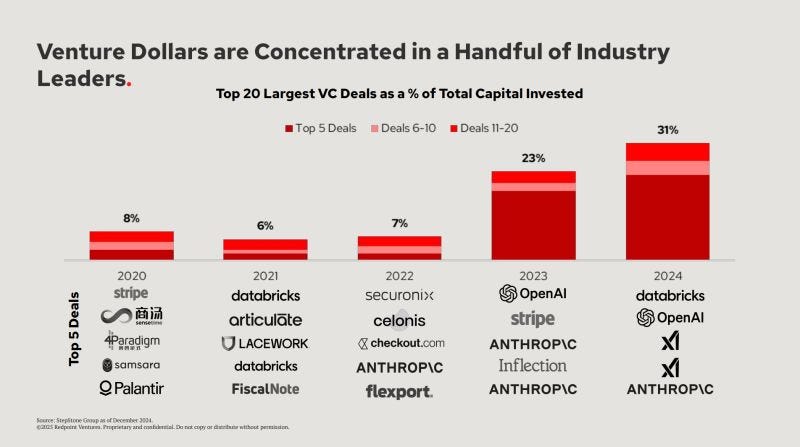

🌊 Private Market Updates

What Happened

Redpoint dropped one of the clearest data sets on the current funding environment—and it confirms what many feel:

AI is accelerating, while everything else is stuck.

The Details

Only 9% of S&P tech companies expected to grow >20% this year

SaaS multiples bifurcated → 14.7x (top tier) vs. 4.7x (median)

Private deal volume is up—but valuation compression still real

AI startups hit $5M ARR in 24 months (SaaS avg = 37 months)

+39% valuation premiums at Series B/C for AI

Top 20 VC deals = majority of capital deployed

72% of unicorns haven’t raised an up round since 2021 → stuck in “Zombieland”

IPO bar remains brutal → $500M+ revenue and profitability

GenAI budgets expected to 3x by 2028 → $401B projected spend

“Service-as-Software” shift → usage-based, outcome-driven pricing replacing seats

So What?

Infra and agentic platforms are commanding real capital, fast growth, and premium multiples

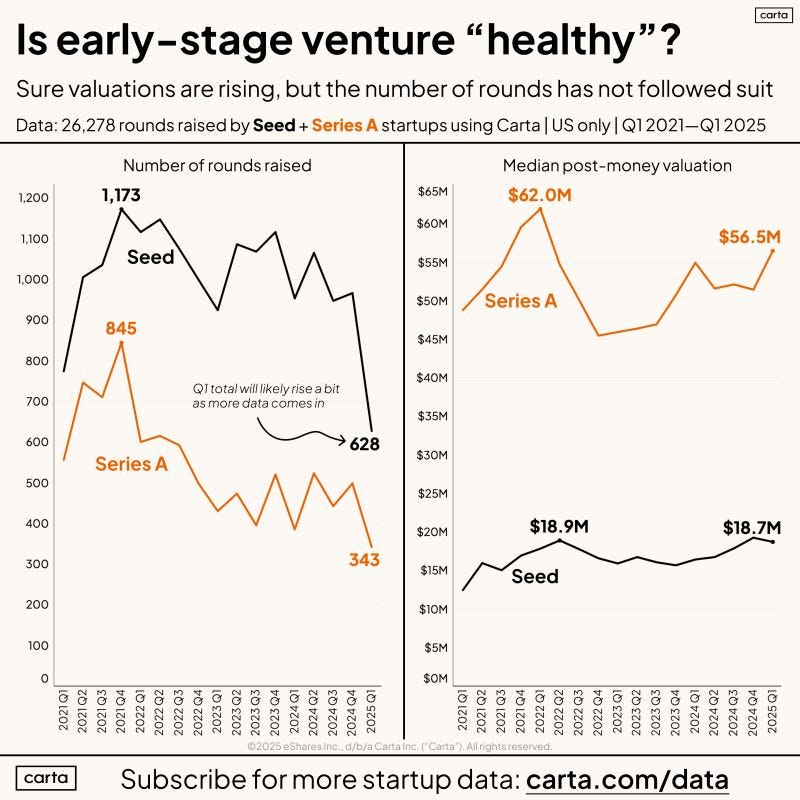

This isn’t (just?) a bull market but likely a barbell market where you’re either in the breakout bucket or you're stuck. This data from Peter Walker shows something interesting, in his words:

The number of actual rounds raised in Seed and Series A is well below 2021 peaks, especially for Series A.

On the one hand, AI bullishness is pushing up the valuations of AI-native early stage companies, which dominate headlines, which paint a rosy picture of startupland.

On the other, due diligence is taking longer than ever, many funds are not really investing, founders are struggling to find investors and some investors are struggling to win the deals they most want.

Redpoint’s full report — one of the few that cuts through the noise.