👋 Hello! I’m Ivan. I write monthly about the playbooks and hidden tactics of the top 1% of founders and investors. Subscribe to stay ahead of the curve:

Summary

🌊 Founder Comp: How Much Should You Pay Yourself?

🌊 Pricing Strategy: 0 to 1 curated resources.

💵 Iberian Deals: 22 deals in Spain (>€250M).

🍫 Meme of the month: startup life

This newsletter is sponsored by Yellow Birds Creative.

Creating organic content for your socials is tough. It's even tougher to do so in a way that accurately reflects your brand identity. We offer three packages:

Content creation: photography, video, video podcasting, copywriting.

Social Media Management: taking care of all your content creation needs.

Project Management: ideate, plan, and manage your marketing initiatives.

In this edition, my internet friend Enzo Avigo, founder at June.so (YC backed analytics startup), takes us down the founder compensation rabbit hole. Lets go:

🌊 How Much Should You Pay Yourself as a Startup Founder?

Founders tend to be secretive about their salaries. I don’t really blame them. For one reason or another, this whole subject is shrouded in secrecy. But this secrecy means that too many aspiring founders make some serious mistakes when deciding what to pay themselves.

Some founders fall in love with full-time salaries. They get security and peace of mind, but this comes at a price: an unwillingness to take risks, to go all in. They get too comfortable, so they’ll never know if they had a great idea.

At the opposite end of the scale, there are those founders who simply don’t pay themselves enough. This means their startup journey becomes much more of a struggle than it ought to be – and the startup journey’s already hard enough!

And then there are those founders who commit themselves totally to raising money. Profit takes precedence, and this can really hamper product development. Are you solving problems and building something great, or are you just looking to make some money?

I don’t expect all founders to be totally transparent about their salaries. But I do think that, if we were all a little bit more open about how much we pay ourselves, fewer aspiring founders would make these common mistakes.

While online calculators, such as the one from Creandum, can offer a good starting point, they often lack the necessary granularity and data points, so I undertook a month’s worth of research into founders’ salaries.

In this post, I will:

Share some founder salary benchmarks you can find everywhere online, along with some real-world figures taken from some founders I’ve spoken to. I’ll also get candid about my own salary.

Explore how founders manage to get by with all the financial ups and downs that come from running a startup.

Study the founders who got rich and try to understand just how they did it.

Let’s go.

The Current State of Founders’ Salaries

I recently shared my salary on LinkedIn. I also recently reached out to a number of VC-backed founders like me, many of whom were kind enough to speak openly about how much they pay themselves. I’ve crunched the numbers, and I’ve come up with some good ballpark figures for founder salaries in 2024.

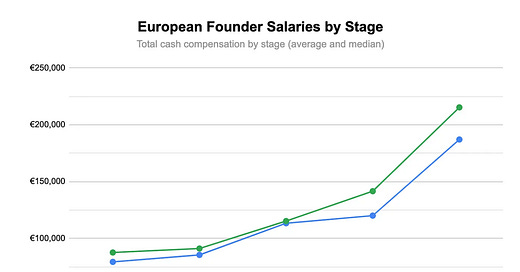

I found that founder salaries vary depending on location, and on how much funding the startup’s managed to raise.

In the US, the median salaries for founders based on funding levels are:

In the EU, founders generally pay themselves less:

Beyond funding and location, a few other factors determine the average salaries for founders:

Industry – Founder salaries are higher in some industries than others. For example, healthcare and biotech founders tend to pay themselves 20% more than SaaS founders.

Gender – Unfortunately, there’s a bit of a gender pay gap when it comes to founder salaries. Female founders tend to pay themselves nearly 25% less than male founders.

Family – Founders with kids generally pay themselves a higher salary than childless founders. It can be an additional €10k per year, per kid.

Co-Founders – It seems to be the case that the more founders a startup has, the less each individual founder will take home.

Some Founders Still Forego Salaries

It seems that, on the whole, founders' salaries have risen over the past couple of years. But at the same time, there’s also been a rise in the number of founders who don’t pay themselves any salary at all.

Most founders will forego salaries in the very early days of their startup journey. But as their startups grow, founders who don’t pay themselves will have to rely on their savings to get by. For some founders, this isn’t a problem. If you’re a serial entrepreneur, and you’ve already got a number of successful startups under your belt, you can afford to bootstrap your business.

But if you don’t have savings or experience to fall back on, things can get very tough, very quickly. I spoke to Grant from Tella.tv about his startup journey, and he told me that he wished he’d taken a salary much earlier. He and his co-founder burned through their savings to get their startup off the ground. And he now recognizes many moments where things would have been significantly easier for everyone if he just had a bit of cash to draw from.

Working flat out while burning through your savings – it can feel like you’re paying twice the price that others pay, and this is a path to frustration, exhaustion, and burnout.

Here’s Why It’s Not Always a Good Idea to Forego a Salary as a Founder

Let’s say that you decide to forego a salary as a founder. But in order to pay your bills and your rent, let’s say you juggle your startup work with something a bit more reliable – such as a full- or part-time job, or some contracting or consulting work.

You invest one hour in your startup, and nothing happens. It feels like you’re getting nowhere.

But for every hour you invest in your other, parallel activities, you make around $200.

You start to compare the time you spend on your startup with the time you spend on your parallel activities. And you find things to be lacking. With one, you get good, solid, reliable rewards. With the other, it feels like you’re getting nowhere. You’re pushing a boulder up a hill, and the peak is nowhere in sight.

When founders start comparing their startup work with other activities that are more immediately rewarding, they fall into the “salary addiction trap”. They might start to resent the lack of progress on the startup, and instead pursue more parallel activities that promise guaranteed, short-term rewards.

The traditional salary slope is less steep

This results in a vicious cycle – the more activities they pursue, the less time they spend on their startup. So their job or their contracting might really take-off, and they might get used to the peace of mind that comes with reliable income. But in doing so, the boulder will get bigger and bigger. It will get increasingly unlikely that their startup will ever take them anywhere.

Too many founders abandon their ideas when they get too hard, or when the lack of results or rewards get unsustainable.

It’s for reasons like this that, on the whole, it’s not a good idea for founders to forego salaries. Time and again, I’ve seen the no-salary path just pile the pressure on founders.

If you don’t have significant savings, and if you’ve managed to raise capital, then I would always recommend paying yourself what you need to be comfortable. If you’re at least comfortable, then you’ll be better placed to focus on doing a great job at your startup.

Put it this way: if you’re worried about paying bills next month, that’s not healthy. It’s not sustainable, and you’ll never be able to bring your best to your startup if you’re constantly stressed about your personal finances.

Ramen Profitability – Or, Why Founders Still Choose To Forego Salaries

Mmm, ramen. The cheap noodles that make the startup world go round – because so many founders pay themselves so little that ramen is all they can afford to eat.

A ramen noodle salary. That’s usually the first thing that comes to mind when we think about founders’ salaries. If founders pay themselves a ramen salary, it implies that they’re investing all of their resources into their venture.

Y Combinator advisor Paul Graham calls this Ramen Profitability. Startups can become “ramen profitable” if their founders can afford to live on ramen alone:

“A startup can become ramen profitable after two months, even if its revenues are only $3,000 a month, because the only employees are a couple 25-year old founders who can live on practically nothing. A revenue of $3,000 a month does not mean the company has succeeded. But this company shares something with the one that’s profitable in the traditional way: it doesn’t need to raise money to survive.”

Pay yourself a low salary – or no salary – and you’ll demonstrate that you’re committed to your startup, and that you’re willing to risk it all. Founders on ramen salaries use their funds to keep growing and to keep hitting milestones.

Venture capitalist Peter Thiel once suggested that a low CEO pay is a key indicator of a startup’s success. Founders’ salaries, he said, set a precedent:

“The CEO’s salary sets a cap for everyone else. If it’s set at a high level, you end up burning through a whole lot more money. It aligns his interest with equity holders. But [beyond this], it determines whether the mission of the company is to build something new, or just to collect pay checks.”

There is no denying that there are a few advantages to running a ramen profitable company. You’ll get better terms when fundraising, but you’ll also be able to focus on your product or service instead of worrying too much about raising funds.

Plus, if you’re disciplined enough to pay yourself such a low salary, then you’ll probably also be disciplined enough to keep your expenses low in other areas. And above all, ramen profitability is good for morale. It shows everyone else in the startups how committed you are, and this commitment can be contagious.

But that’s not to say that all founders should pay themselves a ramen salary. The idea that founders should starve themselves, and that all of their funding should be used just to grow the company, strikes me as pretty old-fashioned.

Modern investors know that founders cannot focus on their business if they’re worried about paying rent, or bills. So even if you’re a pre-seed founder, don’t be afraid to have a healthy and constructive conversation about salary with your investors.

You have to eat. You have to live. You cannot live on ramen forever, and we’re all struggling with the effects of inflation. So typically, once you’ve raised a seed round, you should be able to compensate yourself in such a way that you’ll at least be able to afford to live.

How Do Founders Deal With Uncertainty?

Your journey from ramen profitability, to raising rounds, to taking home a comfortable salary, will be fraught with uncertainty. How can you make your startup a success without this uncertainty taking its toll?

The trick is to remind yourself that uncertainty comes with the territory. Tell yourself that this is what you signed up for. This is what all founders must contend with. As Ben Horowitz puts it, you need to “embrace the struggle”.

You need to be resilient. Mindfulness and scenario planning can help you maintain your focus while ensuring you’ll be able to survive and thrive no matter what comes your way. Embrace a learning mindset and treat every setback you encounter as a learning opportunity. In this way, uncertainty can stop being a source of stress, and instead become a catalyst for growth.

And of course, you could always work to address the uncertainty, so as to reduce it. Take the time to get to know your customers and your market, so you’ll know what you need to do to strike a chord. And know what to measure. Use a tool like June to understand how people use your product, what they like about it, and what they don’t like. This way, you’ll always know exactly what needs fine-tuning to keep things moving in the right direction.

How Do Founders Get Rich?

Running a startup is inherently risky. As we’ve seen, uncertainty is inevitable. But it can be managed – and a good way to keep yourself going when things seem tough is through reminding yourself of the many, many rewards that could await you once your startup takes off.

Yet you might be wondering - if you’re paying yourself around $50k a year in the early days, and around $150k a year after around three years, how do founders ever get rich?

The financial journey of a startup’s founder

Well, not usually through their salaries. But there are a few ways for founders to make bank:

IPOs – If you can grow your company to a successful exit, and if you still have equity, then you’re looking at a very, very big payday. The median is around $268m.

Secondaries – Some founders sell a small slice of their equity before exit. This is known as “secondaries”, and it can be a good move to make when the startup’s doing well, but when IPO still seems like it’s some distance away. HubSpot co-founder Brian Halligan suggested that founders might feel comfortable selling 5% or less of their holdings if their startup’s been valued at $100m or more, and if the revenue’s $8m - $10m or more.

Sell and acqui-hire – An acqui-hiring arrangement involves one company buying another primarily for its employees. The founder will negotiate the acquisition based on cash and stock options, and they often end up making a substantial amount – often around $1m per person recruited. For example, when Facebook acquired Instagram for about $1bn, Instagram’s founders, Kevin Systrom and Mike Krieger, did very well with their respective 40% and 10% stakes.

Conclusion - Imagine Never Having To Eat Ramen Noodles Again…

In the beginning stages of the startup journey, many founders barely pay themselves enough to live on. These founders may choose to live on instant noodles so as to keep the business running with whatever little money they have.

Once they get some investment, they can start paying themselves a bit more. But it's still not going to be crazy money. They still need to balance their own needs with their business's needs.

The real chance to hit the jackpot comes if the company gets sold, goes public, or by selling secondaries.

On top of figuring out money stuff, founders also have to deal with a ton of uncertainty, which can make the journey pretty intense. It's not just about the cash. It's about keeping your head straight, and avoiding burnout at all costs.

Uncertainty might come with the territory for founders. But let me tell you how we can help you manage a lot of that uncertainty. We can help you figure out exactly how people use your product. Who sticks around, and why, and what makes people leave? And we can help you use that information to improve where it matters most.

At June.so we have dozens of ready-made analyses to help you understand why users and companies stick around. All of these insights are available out of the box, with just one line of code. If you’re serious about building a product that people love, then check out June.so.

🌊 Pricing Strategy

Pricing strategy is hard and underrated for startups.

So I curated the top resources on the internet to help get you started:

💵 Iberian Deals

You love startups and want to enjoy a Spanish lifestyle?

Come join the Spanish startup ecosystem.

Here’s a list of recently funded startups:

Our recent deals at JME.vc:

Kampaoh (glamping) raised €8M.

XRF (AI Defence Tech) raised 2.3M.

Hoola (€800K) Conversational AI for eCommerce.

Rauda AI (€520k), AI agents for customer support.

Other rounds:

Osapiens (supply chain software) raised $120M.

Wallbox (EV charging solutions) raised €45M.

BizAway (business travel startup) raised €35M.

Tuio (insurtech) raised €15M in equity and debt.

Geodesic (water treatment technology) raised €14M.

Vaxdyn (biotechnology) raised €14.5M.

Insurama (insurtech) closed a €5.5M debt raise.

Nurture (educational app for children) raised $2.8M.

Masterplace (edtech company) raised 2M.

Optare Solutions raised €1.7M.

Dost (automated financial processes through AI) raised €1.5M

Samara (energy) added €1.5M to its Series A.

Clarity AI is finalizing a funding round of several tens of millions.

Inspiration-Q (quantum-inspired solutions) raised an undisclosed amount.

Silk (€700k), payments software for tenants and property managers.

AsFin (€400k), digital platform for financial advisory.

Alaska Circular (€335k), marketplace of used furniture.

Speakspots (€200k), AI for travel planning.

Kokuai (€260k), health tech.

🍫 Meme of the month

If you enjoy Startup Riders, I’d really appreciate a share - see you next month! 🤙

Great article, thanks for taking the time to put it together.

Could I check the US average salary data, which seems low. It also lower than the EU data ("In the EU, founders generally pay themselves less"), which I don't think quite tees up.

Many thanks, Ben S.