🌊 The 10 Fastest-Growing AI Startups

A data-driven review of who's gaining the most customers right now.

👋 I’m Ivan. I study how top 1% startups raise and grow.

One of my favourite things to do is track early, underrated data sources that give us a glimpse into the future.

Imagine my delight when I found Ramp’s software vendor data.

They process billions in business expenses across 50,000+ companies on their corporate card and bill pay platform. That means we’re not looking at what founders claim or what VCs fund but at what finance teams actually approve (real PMF).

I enriched Ramp’s trending vendor list with funding data, revenue estimates, and investor intel to answer:

Which AI startups are actually winning customers (not just raising money)?

Today’s tl;dr:

📈 Who’s gaining customers fastest.

🔎 Their efficiency numbers are outstanding.

🌊 Three patterns the spend data reveals.

💰 Five VC funds keep showing up.

🔐 The breakout list + full dataset.

Let’s get into it:

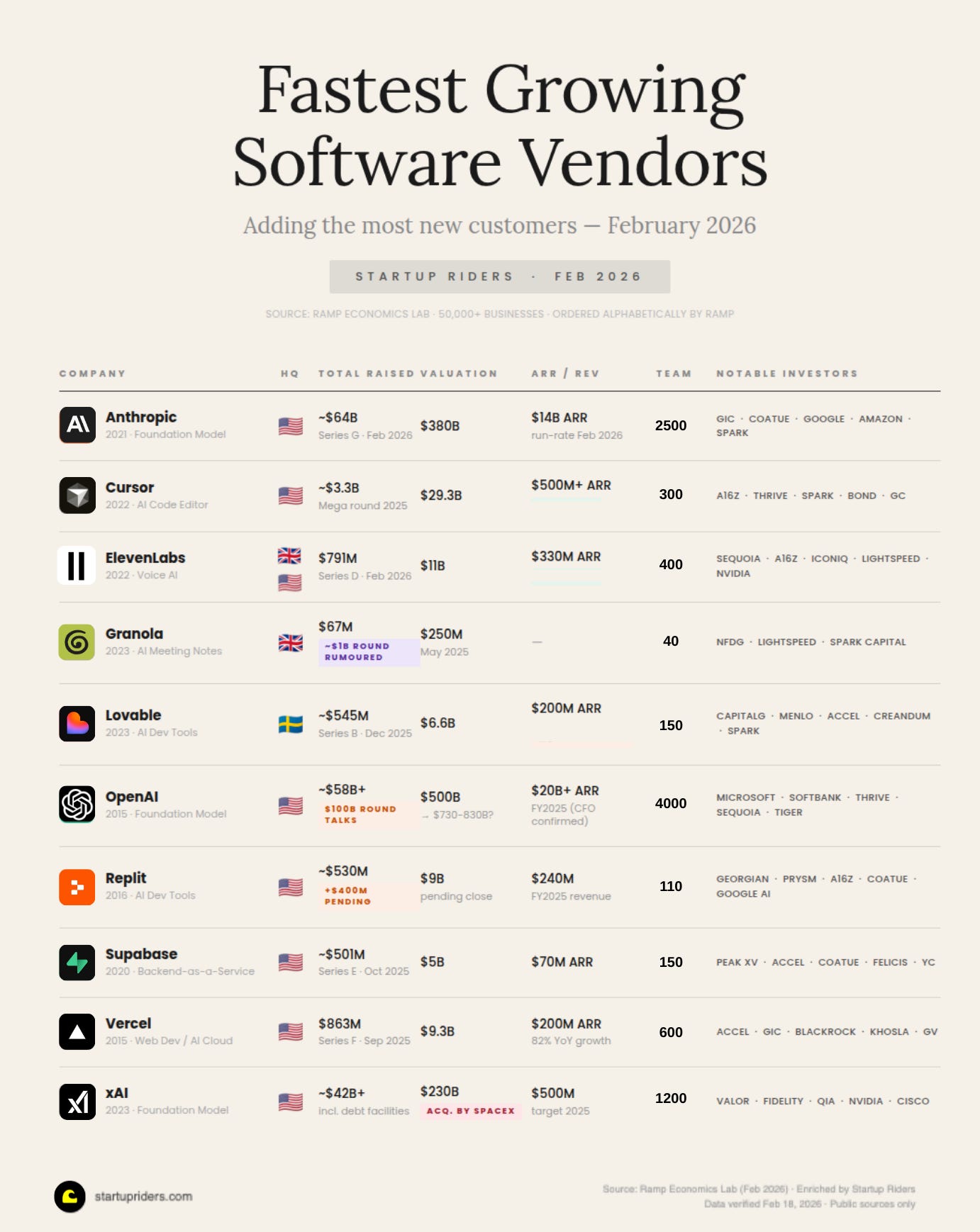

📐 Quick note on methodology: Ramp’s “fastest growing software vendors” ranks companies by net-new customer additions on their platform. It skews US, mid-market, and tech-forward. I suspect it doesn’t measure total revenue or usage depth just adoption velocity. I enriched the top companies with funding, valuation, team size, and ARR data from public sources. Treat all numbers as directional.

This week’s sponsor is AI CRM Attio!

Attio is the AI CRM for modern go-to-market teams. Attio connects to your email, calendar, calls, product data, billing data and more — so your CRM is always complete, always enriched, always in sync.

Prep for any call in seconds with full context across your business

Instantly prospect and route leads with research agents

Build powerful AI automations for your most complex workflows

1. Who's Gaining Customers Fastest

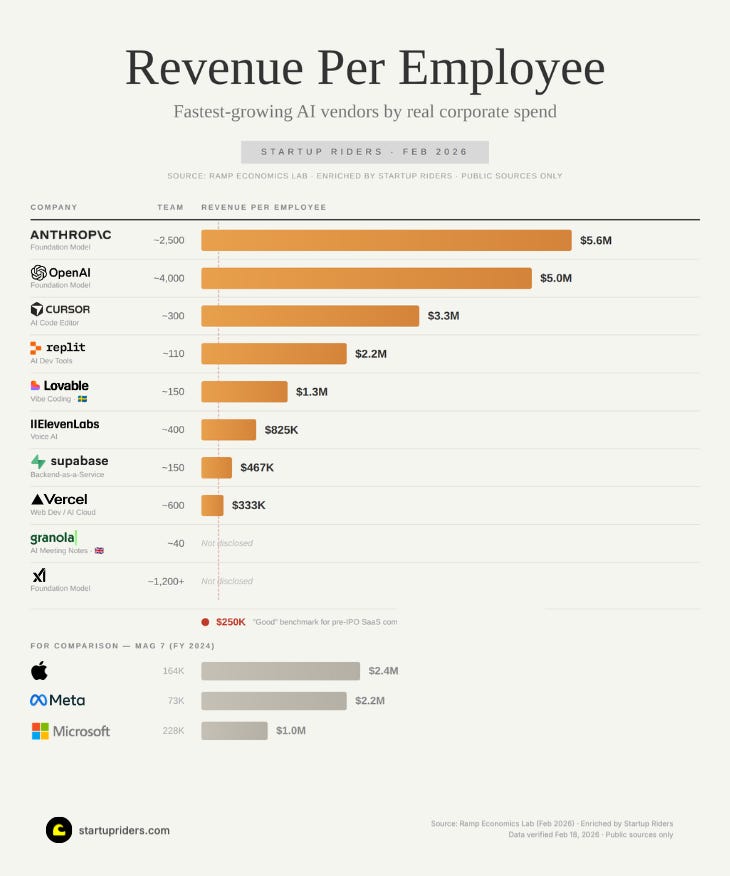

2. Their Efficiency Numbers Are Outstanding

For context, Apple does roughly $2.4M per employee. AI-native startups are already matching or beating the Mag 7 on this metric with a fraction of the headcount:

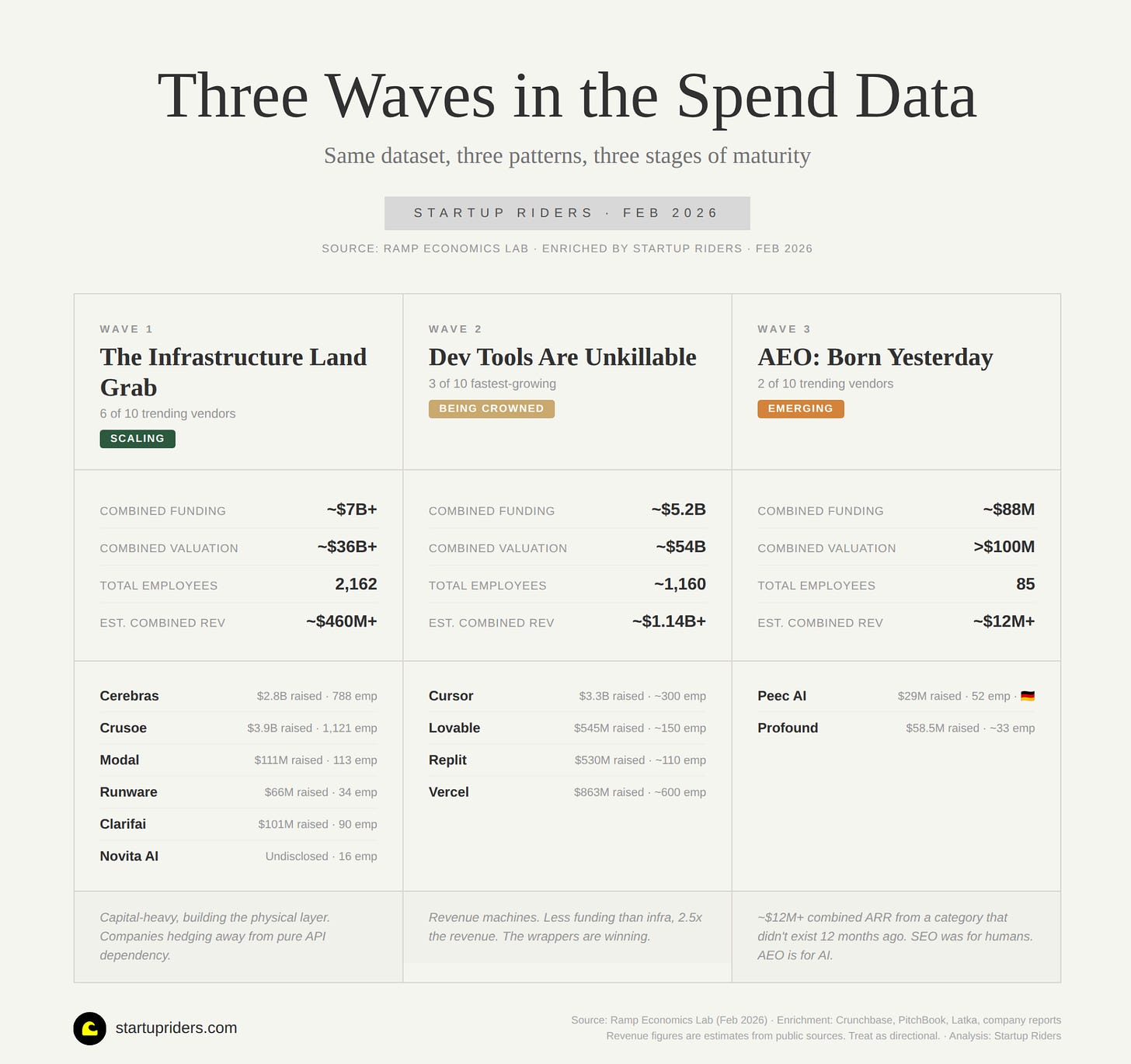

3. Three Patterns the Spend Data Reveals

The spend data clusters into three distinct patterns, each at a completely different stage of maturity:

Infrastructure: 6 of 10 trending vendors are AI infra. $7B+ in combined funding and $400M+ in revenue.

Dev Tools: Cursor, Lovable, and Replit are on the fastest-growing list despite Anthropic and OpenAI shipping their own coding agents. Less funding than infra, 2.5x their revenue. The wrappers are winning (for now!).

AI Engine Optimization: Peec AI and Profound are trending (AEO barely existed 12 months ago).

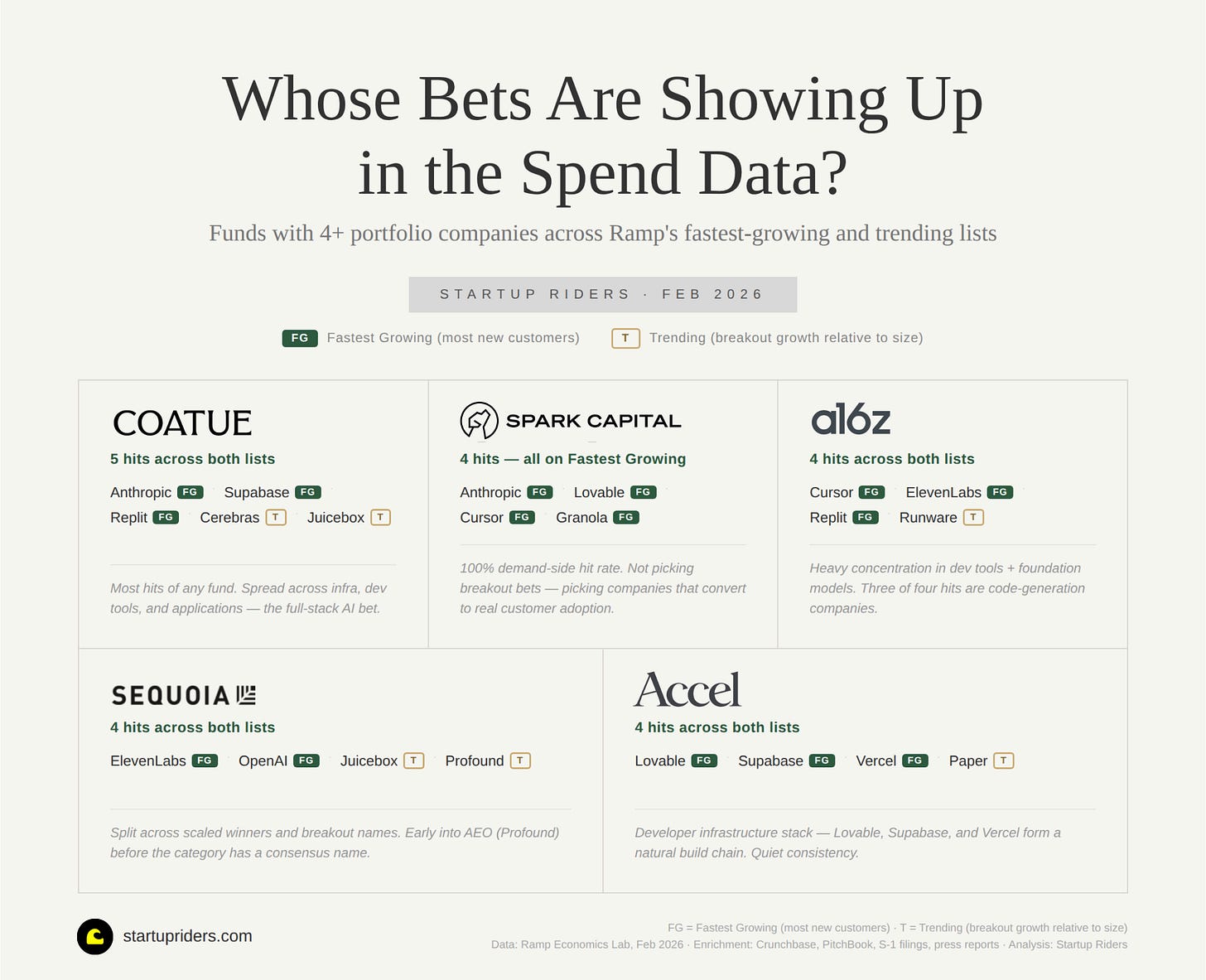

4. Five Venture Capital Funds Keep Showing Up

I mapped which funds appear most across both Ramp lists, fastest-growing (most new customers) and trending (breakout growth relative to size), to see who’s picking winners on both sides of the data:

🔐 The Breakout List + Full Dataset

The 10 breakout AI vendors, enriched 👇