🌊 Europe accelerates

Big AI rounds, fast growth, and real capital moving this month

I’m Ivan. This is a weekly brief on where venture capital flows and how top 1% startups grow.

This week’s sponsor is AI CRM Attio:

Attio is the AI-native CRM for the next era of companies: Connect your email and calendar, and Attio instantly builds a CRM that matches your business model — with all your companies, contacts, and interactions enriched with actionable insights. With Attio, AI isn’t just a feature - it’s the foundation. You can do things like:

Instantly prospect and route leads with research agents

Get real-time insights from AI during customer conversations

Build powerful AI automations for your most complex workflows

Hello there! This week I had lots of vc meetups and almost got Tarikoplata’d in bjj.

The main thing on everyone’s mind is (still…) the bubble vs no bubble debate. What most people miss is that sure, there will be a pricing reset, but the “ask AI” default habit is out of the bottle.

And once you start outsourcing intelligence like that, and you realize most of the world is still mostly oblivious to this change, watch what happens in the mid-run.

Great for innovation, but a hell of a lot of creative destruction incoming.

So, here’s what went down in startup-land this week:

🤖 AI

I published a list of the top 40 European AI startups that raised over $50M so far in 2025. So much talent coming out of the old continent in this wave. Interesting to see an important subset of 10 of those making a big splash in Healthcare AI.

We’re witnessing the fastest scaling, and highest-valuation-per-employee AI startups in history this year in 2025. Startups leading the charge include Figure, Cognition, Anthropic, OpenEvidence, Decart, Sierra and many others on that list.

OpenAI restructured to become the richest charity in history. Not a surprise considering ChatGPT’s retention curves.

Replit (vibe-coding app we used here a couple years ago to demo Pitch Deck GPT remember?) shared revenue numbers that went from $2M → $250M in 2 years.

Google demoed a new chip called Willow that cracked a complex problem 13,000x faster than today’s top supercomputer, thanks to a breakthrough technique called Quantum Echo.

Jeff Bezo’s explanation of the ai bubble and why it is going to be transformative regardless of price adjustments is pretty spot on and worth listening to.

Sam Altman and Satya where on this pod together sparring on the future of ai agents and how, because OpenAI’s most advanced models stay tethered to Azure, Microsoft owns the on-ramps for enterprise AI.

Found this great visual on why you should never underestimate Google, showing how they are the only player that is truly vertically integrated in AI.

🌊 VC

I wrote about why I’m bullish about european tech startups and Swedish unicorns (20+, latest being Legora), with 5 key ecosystem lessons we should export to the rest of the old continent.

I shared a list of the top 50 EU startups that raised a series A this month. Interesting to see 19 took place in the UK, seeing strong biotech and industrial AI presence, deeptech > saas and B2B heavy. Also published 20 spanish startups that have raised a round in October 2025.

Seed VC funds are having an existential crisis. Rob from Nextview breaks down 4 main reasons, which I found fascinating:

The industry matured into a barbell: megafunds a-la Squoia and scaled “crafty” seed-specialized funds. Everything in between is hollowing-out, and there are now just too many Seed funds.

YC and megafunds: YC represents 40 seed funds worth of competition and makes up at least 10% of the overall institutional seed market. Together with other growing megafund programs like a16z speedrun these likely make up c.25% of the seed market, and growing. Their models are orthogonal to the institutional seed model in most cases.

The power law is now consensus thinking: made “worse” by super-outliers being larger than ever and exit markets supporting a “go-for-broke” approach (500M+ to IPO vs 100M).

AI Platform shift: all 3 previous points turned all the way up + most of the value being accrued deeper in the tech stack, what Bill Gurley calls “a sport of kings”, meaning deep pockets needed.

My 2 cents: I agree consensus seed deals are crowded. But real non-consensus isn’t actually being bid up, because true non-consensus still feels uncomfortable or way early or “weird”. And because mimetic desire seems to send everyone to the same signals (YC / a16z etc), which I’ve been seeing a lot of lately.

Also on a positive note, Adam from True Ventures argues the opposite, that there’s never been a better time for innovation, that we need more of everything (founders, programs a-la yc, seed managers etc), but with a clearer angle / differentiation.

Carta published data on how crazy the valuation expansion at Seed has gotten, from 10M median post-money valuation in 2016 (when Seed wasn’t yet a “thing”) to a whopping 20M today, and 80M (!) at the top of the range (98th percentile).

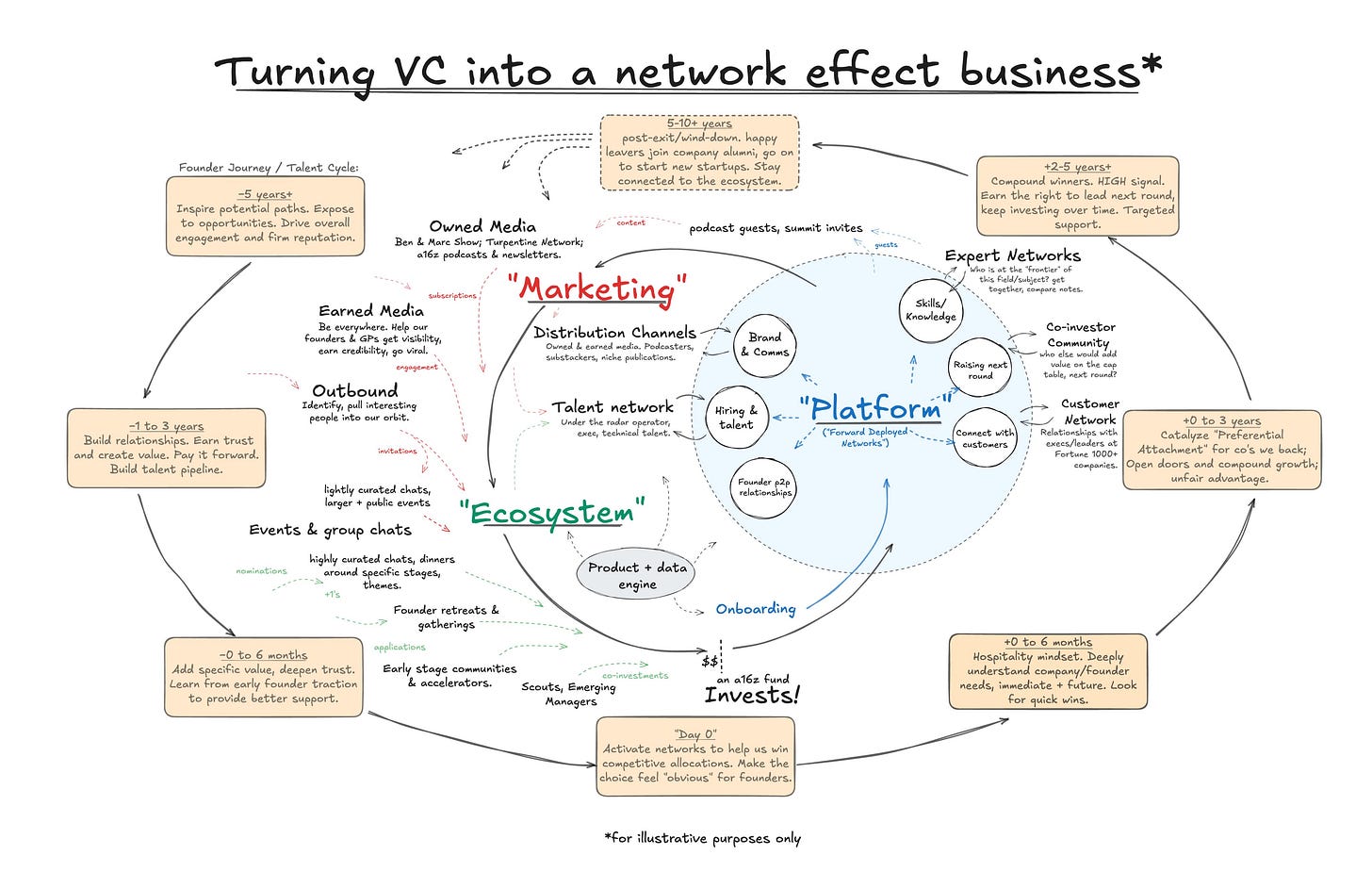

Loved this visual by a16z on how they’re turning VC into a network effect biz:

📈 Founders

I had a great conversation with Rodri founder at Crossmint (recently raised >$20M).

His trajectory bends every rule in the traditional playbook: sleeping on buses in London → Stanford GSB dropout → months in a Zen monastery → emerging with the conviction to build programmable money infrastructure for the internet:

🌱 Favourite startups from YC’s fall 2025 batch:

From those published so far:

🇺🇸 Kalpa Labs: Building frontier speech models + agent voice-infrastructure for long-form convo flows.