🌊 Terra

Hi! I’m Ivan Landabaso, VC at JME.vc. Join >2.2K founders and investors surfing emerging tech waves and profitable business trends, twice a month.

Terra Ecosystem 🌕

A lot has been written on the subject of Decentralized Finance lately. If you know nothing about the subject, watch this first for a great overview.

As a quick refresher, to get you ready for the Terra Ecosystem rabbit hole:

Decentralized finance (DeFi) is an emerging field that leverages blockchain technology to remove the need for financial intermediaries - replacing them with code. Some of the reasons DeFi has attracted so much attention lately include:

(Much) lower transaction costs: reduces fees and inefficiencies that banks and other financial intermediaries charge for using their services - often in a predatory way with shockingly bad customer service (because they can).

(Much) lower transaction and payment settlement times: You can transfer funds more often than not in seconds or minutes, as opposed to days / weeks.

Increases access to financial services: Anyone with an internet connection can use DeFi without needing approval from anyone (globally 1.7 Billion people remain unbanked).

Built-in rewards for participants: those participating in a particular protocol can earn rewards for fulfilling a network need.

It is becoming a really big deal, with outstanding growth over the past year in total value locked (aka the sum of all assets participating in DeFi protocols earning interest, rewards, airdrops / new coins other rewards):

There are multiple chains “competing” to dominate DeFi (although many work together and/or complement each-other). With Terra being a clear outlier in terms of growth in 2021.

⚠️ None of this is investment advice. The intention here is to shed light on an interesting emerging ecosystem. Remember these are all experiments, and can collapse to 0 at any time. Do not invest in anything ever without doing your own research, and do so thoroughly. Never invest more than what you can afford to lose. This post is not an endorsement of any web3 project.

😟 Problem

Transaction fees and settlement times in the traditional payments market are costly and suboptimal for the world.

🤩 Solution

Enter the Terra Ecosystem - a “layer 1” protocol armed with practical products, including a decentralised algorithmic stablecoin called $UST, that aims to eat at the enormously large payments market.

$UST relies on a clever mechanism - a set of on-chain incentives - to maintain parity with the US Dollar - without relying on it, and is phenomenally cheaper and faster to use than traditional financial infrastructure.

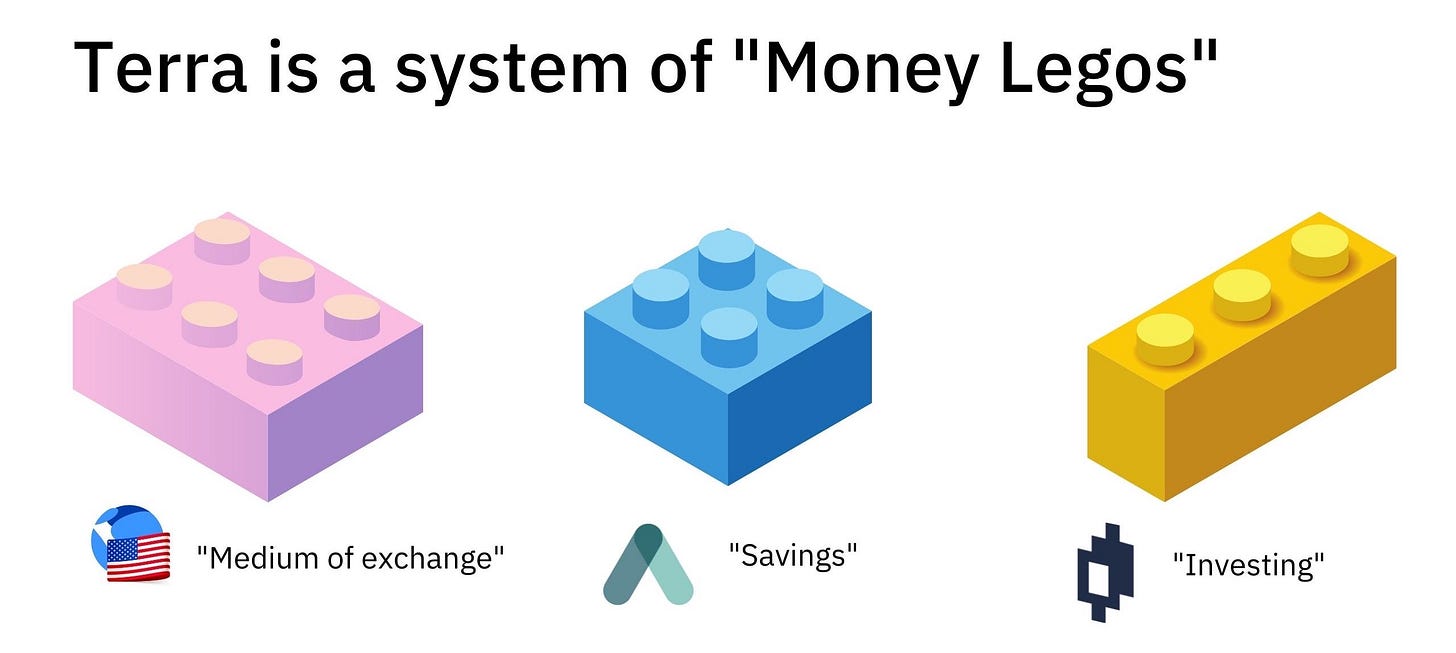

It is already being used by millions of people to pay for everyday items, but it is also on its way to become an important space for all things money in web3 including banking, savings, investing and more.

⏳ How we got here

The Rise of Do Kwon (aka StableKwon)

Do graduated from Stanford and went on to spend some time at Microsoft, where he quickly realised only 4 out 40 Engineers on his team were doing real work 😏. He then left to work on his startup Anyfi, in an effort to “Connect the world for free” through mesh networking. Say you’re connected to wifi, and you have the anyfi app installed, your phone could extend the range and grant access to those out of range.

Not long after, in 2016 he got randomly invited by a college friend to a Facebook chat room with 8 people (which he initially thought was spam), in which Ethereum and other crypto projects were being discussed. This led him to deep dive across a range of whitepapers, spend time at meetups, and starting to tinker with some projects.

He finally takes the leap to build Terra end of 2017, when he meets cofounder Daniel Shin in late 2017. So you get a better idea of the company’s DNA, Daniel was one of the first people to bring ecommerce to South Korea in 2010. He founded an ecommerce portal with >10M monthly active users. They started talking about what an actually useful cryptocurrency should look like when Daniel was considering investing into a relatively obscure coin - and the idea of Terraform Labs was born!

Terraform Labs

Terraform Labs’ mission is to break down money as a product, and think through what features of money can be improved with a decentralized version of the USD.

The mission is to make $UST the easiest money to spend, and most attractive to hold, with utility at its core.

The Rise of $UST and $LUNA

Think about the Terra Ecosystem as the fabrication of money from scratch (a stablecoin) + a sorrounding financial system.

Why is the $UST stablecoin at the core of this system?

Medium of exchange: having wild variations in its price ala Bitcoin isn’t helpful. Instead, $UST is built to trace the price of the USD almost second-to-second.

Store of value: a stablecoin serves as a safe-harbour for investors to move their money around crypto without having to go back to FIAT.

Attracting money flows: without a stability component, many more “risk-averse”(ish) investors wouldn’t participate in certain forms of staking (aka locking up your coins to help secure the network, in exchange for a fee - basically you become the bank and get paid for it).

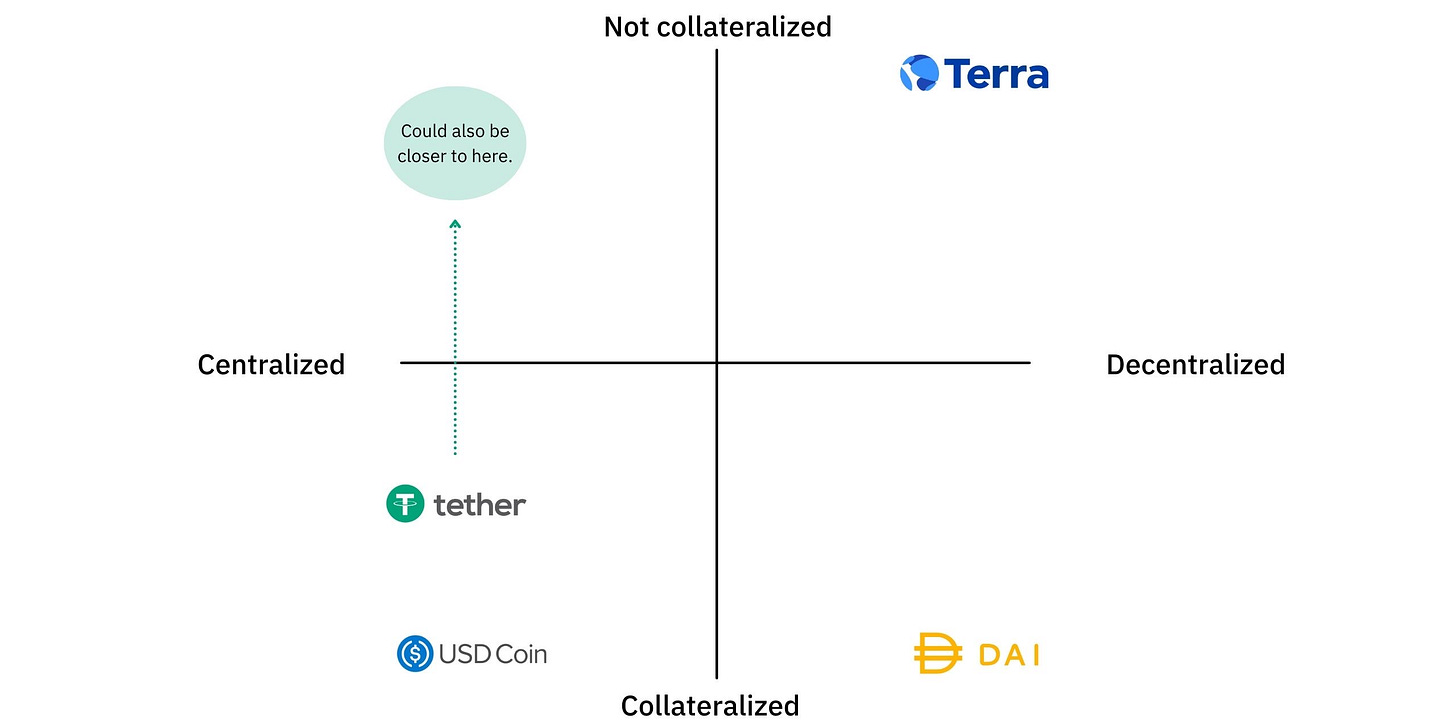

Sure but how is Terra’s $UST different than other crypto stablecoins?

Decentralized: $UST positions itself clearly on one spectrum of this important trade-off. The primary benefit is that it is harder to regulate by external bodies. The primary drawdown is time-to-consensus, potentially moving slower (stakers of LUNA, which we’ll talk about below, can vote on different outcomes proposed by members of the Terra Ecosystem).

Algorithmic: Instead of being fully or partially collateralised, presumably “securing” your assets with the promise of being able to redeem its equivalent lets say in $USD at any time, $UST maintains it peg algorithmically through a clever on-chain incentives mechanism. The tradeoff here = no collateralization in exchange for speed and scale.

Cool, but how does the $UST to $USD peg actually work?

And what that heck is $LUNA?

Instead of maintaining its peg to the US dollar through collateralization, $UST does so via its other currency $LUNA, which has 3 main purposes:

Governance: $LUNA holders / investors can vote on proposals about the future of the ecosystem.

Staking: $LUNA holders and can stake their tokens to help secure the network - and earn fees in return. It is an asset that produces revenue for its holders.

$UST Stabilization: $LUNA value acts as a counterweight / pseudo-reserve for $UST. For every 1 $UST, a user can redeem 1$ worth of $LUNA. Whenever there’s miss-alignment, the following supply-and-demand stabilization process kicks in in. When $UST's price rises past its peg, Terra's algorithm "burns" / destroys Luna tokens to create additional UST. As UST’s supply increases, its price falls, re-stabilizing the system. This LUNA burning reduced its supply, and incidently increases Luna prices. Same thing happens in reverse.

🚀 Why is Terra special?

Non-Speculative Use-Cases, With Millions of Users

If I had to boil down the main reason why I find Terra fascinating today, it’d be because they are one of the few protocols with proven use cases and millions of Daily Active Users in the “real economy”, particularly when it comes to general purpose eCommerce.

Two major benefits solving 2 real pain points for merchants:

Slow settlement times: on average in Korea traditional payment gateways take 5 days to settle a transaction, in Japan its 7-10 days, in SE Asia its up to 14 days. Terra settles transactions in 6 seconds. The reason why its valuable? If you are a cab driver, you can’t wait multiple days for the sales of one day to find you multiple day later - because you need the working capital (to pay for fuel, food etc.). The same happens to SMBs and restaurants - you really can’t wait that long, and cutting settlement time is a huge value proposition.

High transaction fees: in regions were margins are thin in ecommerce and offline retail, having to pay up to 3% in transaction fees to credit card companies and payment gateways is WAY too expensive. Chai offers to its merchant partners 0.5-1.3% in transaction fees. Terra cuts down cost to a fraction.

Success Stories

Chai’s story validates the “use your money” use-case, essentially a payment processing application useful for both enterprise clients (to seamlessly accept remuneration) and consumers (to pay for goods without even knowing they are interacting with a blockchain). What happens under the hood? Terra accepts payment in a fiat currency, translates it into one of its stablecoins (like $UST), and pass it over to a vendor in their local currency - greatly reducing settlement times and fees.

Terra Station’s story and the “store your money” use-case - the place where Luna holders can swap their tokens for UST and other Terra stablecoins, send their tokens to other wallets in seconds, stake their coins with a validator of their choice in exchange for fees, store their NFTs, vote on governance proposals and so on.

Anchor Protocol and the “put your savings to work” use-case - a product designed to be simple, easily usable and ready for mass adoption, Anchor allows users to stake their $UST in exchange for up to 20% in Annual Percentage Yield (aka in a relatively “safe” manner, since you are not subject to the volatility of a non-stable crypto-asset). Holdings are then loaned to potential borrowers across different proof-of-stake blockchains.

Other cool projects I find interesting you should check out:

Insure your money - Ozone

Synthetic asset trading - Mirror

Liquid staking - Stader Labs

Interchain lending platform - Mars

Decentralized Automated Market Maker on Terra - Astroport

User Experience

Do Kwon is a product guy at heart, and it shows on the quality of UX across the ecosystem - if you try Terra Station (wallet), you’ll notice how well designed and easy to use it is relative to other chains.

Engineered for a multi-chain future

Even through Terra operates as its own ecosystem, it has been built knowing other L1 chain can surpass it. Because a stablecoin is at its core, Luna people want it to spread across the cryptoverse!

Huge utility growth over the past 6 months (protocols)

May 2021 (30 projects)

November 2021 (100+ projects)

Attracting Developers

Blossoming Terra Metaverse

With $20M in total volume and over 100 NFT projects launched so far.

🚨 Risks / Drawbacks / Hiccups

"UST" is not collateralized. Given that its value is maintained through algorithms, some have argued that it is "built to fail." There is a precedent.

Among stablecoins, $UST has been known to have the widest spread in volatility (albeit small).

$UST did go through a momentary unpegging in the past - but recovered nicely when many thought it’d be the end.

While the Chai adoption story is probably one of the greatest adoption stories of crypto in the “real economy”, it still has a long way to go when you compare it to South Korean incumbents.

Indirect regulation of $UST by imposing sanctions on $LUNA buyers/holders is a vulnerability vector.

It could fail to attract more and more talent to build the ecosystem out.

Everything else that can go very wrong in crypto.

👌 Hacks

Curious about the ecosystem? Click-to-learn > overthinking.

Are you a builder? Learn Rust and develop the next financial DApp on Terra.

Are you an operator? Explore and join one of the teams in the ecosystem. Join Discords, cold email them on Linkedin or Twitter (3 liner + why/how you’d help).

Be extremely open minded and extremely skeptical - at the same time.

Spend time working back from the assumption that any project can collapse.

🐇 Follow the White Rabbit 🕳️

Terra, an emerging ecosystem - Remi Tetot

Why UST is a superior stablecoin - Kash Team

The rise of $LUNA - Jay J

Yield farming in the Terra Ecosystem - Everstake

Terra Briefing - The Generalist

The Terra Metaverse - Jay J

Why the Luna burn is value additive - Do Kwon

🐦 Web3 Tweeter

Here’s a thread with all the top insights in web3 last week, minus the hype.