🌊 EU Tech

Europe’s $4T tech economy, funding rebound, deep-tech surge, founder boom, pension-fund unlock, and the EU policy shifts that will define the next decade.

👋 I’m Ivan. This is a weekly brief on how top 1% startups raise venture capital and grow.

Hello there!

Atomico just dropped the State of European Tech 2025.

It’s 280+ pages. I read the whole thing so you don’t have to.

Here are the 10 insights that matter most:

1. Europe’s tech economy is now a $4T asset class

What happened:

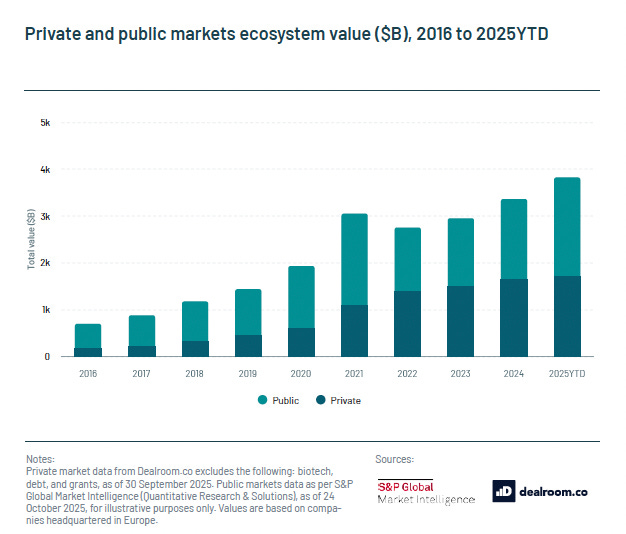

In a decade, Europe’s tech ecosystem went from under $1T to around $4T in combined public + private value, and now represents ~15% of European GDP (up from 4% in 2016).

The details:

The total ecosystem value growing almost linearly post-2016, with only a small dip after the 2021 peak.

Tech is now one of Europe’s biggest “industries” by value creation, even if it still isn’t treated that way politically.

This is happening with far less capital intensity than the US, basically building a $4T asset class on “hard mode”.

So what:

European tech has enough depth (talent, capital, buyers) to build something big from Europe, even if you sell globally from day one. Wrote about Sweden here a few weeks ago.

2. Optimism is back, but confidence is still fragile

What happened:

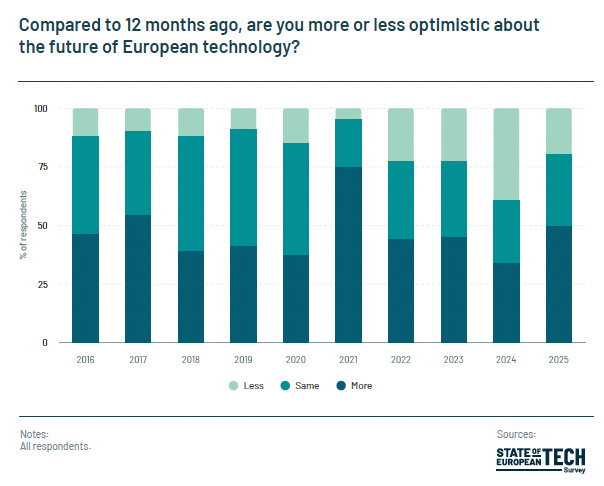

50% of people in the ecosystem feel more optimistic about European tech than 12 months ago (vs 34% last year), one of the highest readings of the decade.

The details:

Sentiment steadily recovering after the 2022–23 hangover.

But, the old continent hasn’t yet convinced its own stakeholders that this is the best place in the world to build.

Europe’s tech share of GDP has quietly crept to 15%, but culturally we still talk like underdogs.

So what:

Founders can be early to take Europe seriously while others hedge (and others just flood twitter with anti-eu memes). The founders who act as if Europe will win, and structure their company accordingly, likely get compounding advantages in talent, policy access, and capital.

3. Funding has bottomed out in Europe, but the US is playing a different game

What happened:

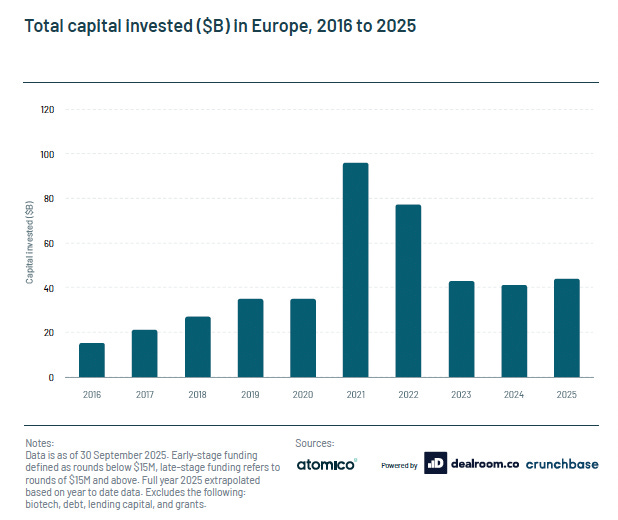

European startup funding is stabilising around $44B for 2025, up from the 2024 bottom but far from 2021 highs. Meanwhile, the US just had a new surge: $177B into tech in the first nine months of 2025, almost double last year, largely driven by a few AI giants.

The details:

Europe’s problem isn’t no capital but rather a combination of: 1. less mature ecosystem (culture, what excellence looks like) with a flywheel that is starting to work (and “less” late-stage capital than the US as a consequence) 2. an urgent need to reform incentives (see EU Inc.) 3. an urgent need to improve access to liquidity and local patient capital capital markets (again good examples here on what Sweden has built).

So what:

If you’re raising Seed or Series A in Europe, the market is “normal hard” again, not existential. But if you’re aiming for global category-winner scale, you need a conscious strategy for the growth stage: either tap US capital early, or be very deliberate about becoming one of the few European companies that local growth funds will stack capital behind.

4. Deep tech & AI are now Europe’s core bet, but ticket sizes trail the US by an order of magnitude

What happened:

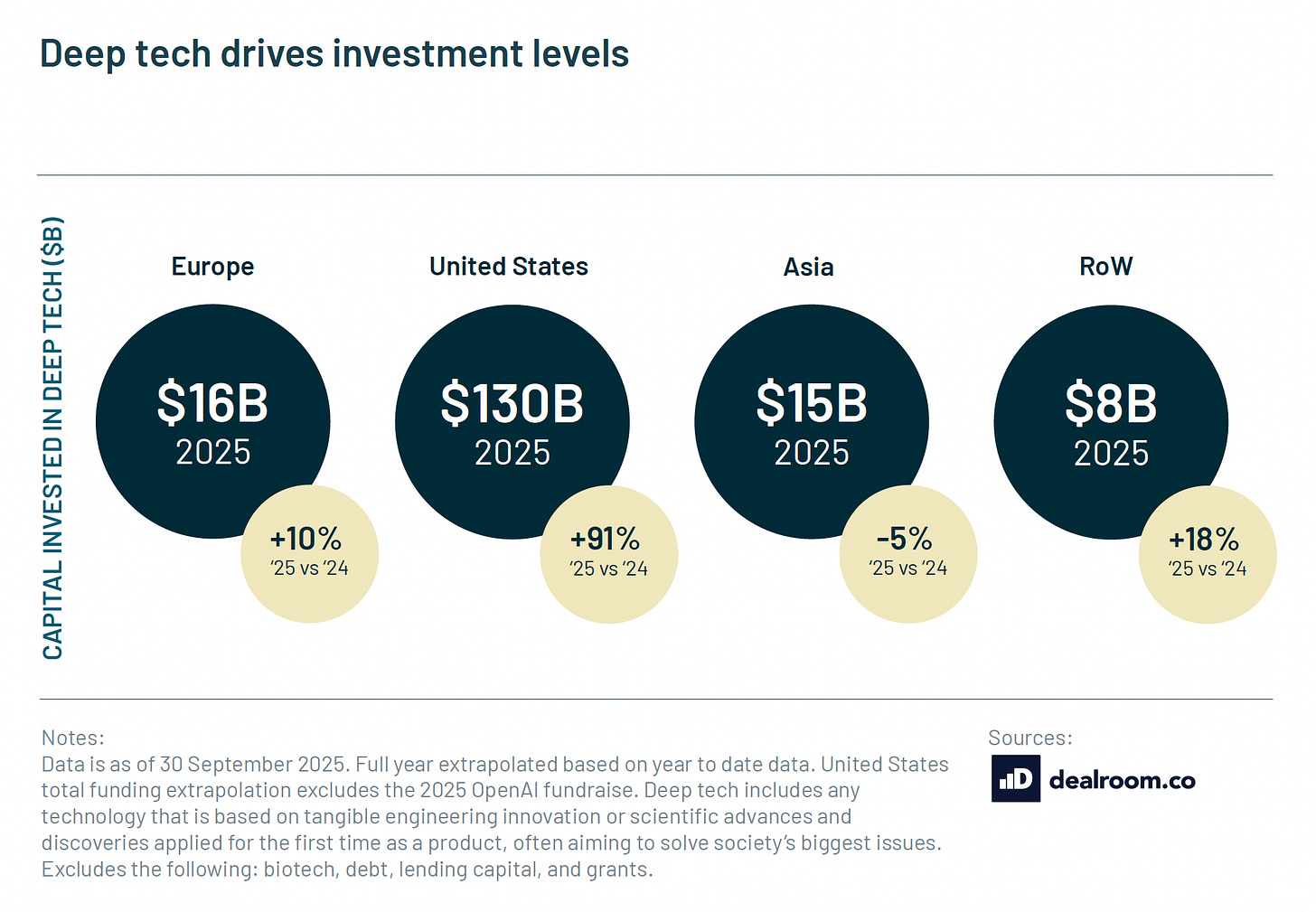

36% of European VC dollars in 2025 went into deep tech (up from 19% in 2021). But where the US stacks tens of billions into a handful of AI giants, Europe spreads $16B across many themes: compute, quantum, defence, mobility, climate.

The details:

The deep-tech chart shows:

Europe: $16B in deep tech (+10% vs 2024).

US: $130B (+91% vs 2024), excluding the monster OpenAI round.

Europe sees big moments: Helsing’s $660M Series D, Isomorphic Labs’ $600M, Proxima Fusion’s €200M, NScale’s $1.1B strategic Series B, but we don’t yet have the same concentration of capital behind a few national champions.

So what:

If you’re building deep tech in Europe, you’re in the right place but don’t assume US-style firepower. The bar is higher on capital efficiency and strategic partnerships.

5. Europe’s founder engine is running hot

What happened:

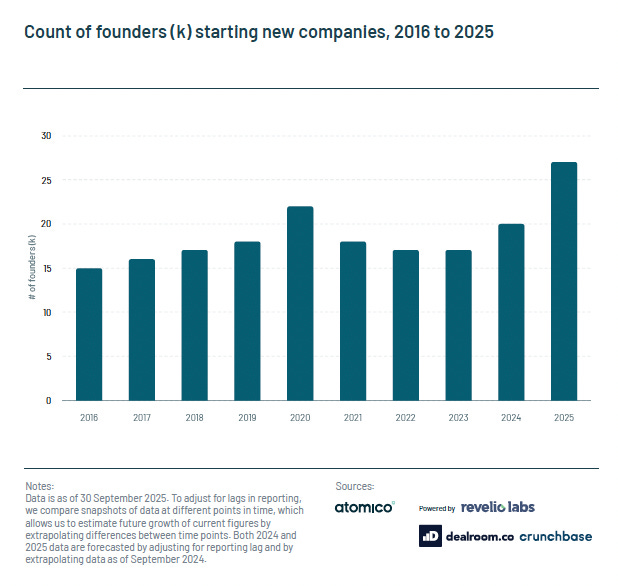

More than 27k founders started companies in Europe in 2025, ~60% more than in 2023, and the highest number on record. Europe still contributes the largest share of global founders, but Asia has now caught up at ~28%.

The details:

Europe’s share of global new founders staying slightly ahead of the US, but Asia (driven by India + UAE) now matching Europe’s share.

Low-code/no-code, cheaper infra, and stronger networks are lowering the barrier to start something everywhere.

So what:

The idea that “there aren’t enough founders in Europe” is now objectively false.

6. Europe keeps most AI founders at home, but seasoned founders quietly incorporate in the US

What happened:

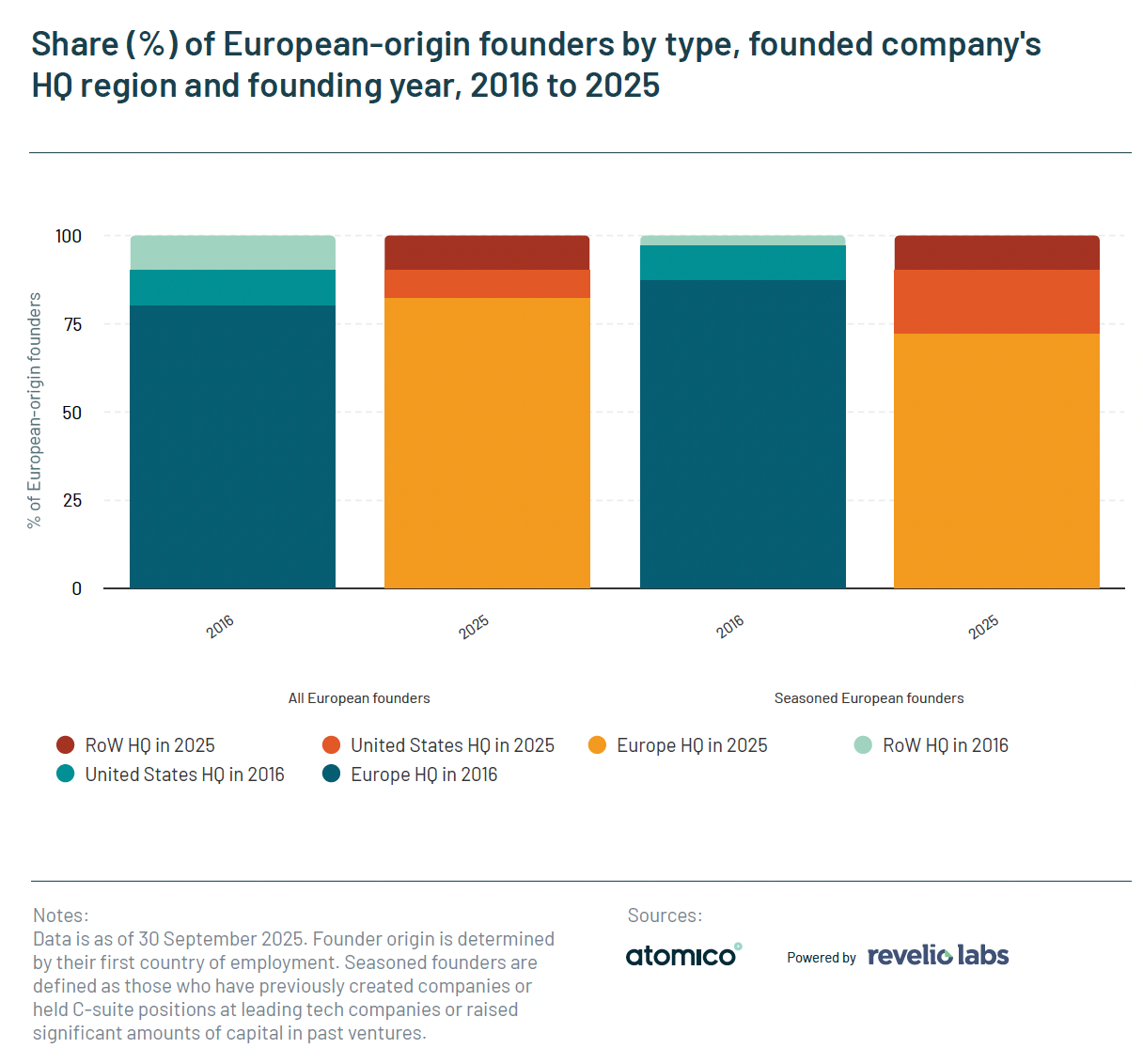

Around 4 in 5 European founders are still building on home soil, and among AI founders that share actually increased from 74% to 81% since 2016. But among “seasoned” European founders, the share incorporating their companies in the US has nearly doubled from 10% to 18%.

The details:

First-time European founders overwhelmingly base and HQ their companies in Europe.

Seasoned founders (previous exits / C-suite / heavy fundraises) are much more likely to pick a US HQ or dual structure.

The report reads this as a proxy for: US incorporation is faster, cheaper, and better plugged into growth capital and public markets.

So what:

Regulators should pay attention at the structural friction that’s making repeat founders move their HQ to the US (and fix it fast, since the eu has now exported over 100 unicorn founders there).

7. Europe’s capital stack is underweight at the top: pensions + late-stage create a $200B+ opportunity

🔐 Startup Riders Pro only: access the rest of this breakdown, plus access to every tier-1 VC report I read each week.