🌊 Bootstrap

4 insights from Fleet on how to bootstrap to €12M in <3 years, pitch deck frameworks, OpenAI's Dall-e 2, 14 startup deals and 12 growth jobs.

🤙 Hey, I’m Ivan. I write about how top 1% startups raise and grow.

Summary

This week’s good stuff includes:

🥾 Bootstrapping: when to fundraise vs bootstrap.

🍬 Startup Candy: Pitch deck frameworks and OpenAI’s Dall-e 2.

💵 Deals & Jobs: 14 startup deals in Spain (>€74M) and 12 growth jobs.

🥾 Bootstrapping

This week Baptiste and Alex at Fleet - bootstrapped company that got to €12m in annualised revenue in <3 years - take us down the bootstrapping rabbit hole:

Bootstrap vs Fundraising: What’s up?

The past few months have been incredible for the European tech ecosystem.

We’ve seen more than 100b€ invested in 2021.

There’s so much press around fundraising that people sometimes associate startup success with fundraising - which are not the same thing.

Raising money is not always necessary, nor the best path forward for every business.

So, lets talk about it:

Do I need to fundraise?

Hard question. You gotta consider many factors: business model, scalability, competition, size & growth of the market, tech & infrastructures needs, timing…

There’s a good number of legit reasons. The market could be very competitive (you should ask yourself if your market is either a blue or red ocean), there could be a big R&D component, a need to grow and hire talent very fast, a desire to expand your model abroad, etc…

When it comes to venture capital, successful VC-backed companies have had a disproportionately large economic impact historically, particularly in the US economy:

Yet, the number of businesses that are in fact investable by venture capital is very, very small. The main reason?

Venture capital funds are businesses themselves, that need to make significant returns to their LPs (their clients) to survive. VCs look for “home run” businesses to make their own economic model work (look at the size of a fund and how many investments they make). Check out the distribution of realised US VC outcomes over the past 10 years, and you’ll get a better understanding of the model:

This means, almost by definition, that VC funds are typically looking for non-consensus and right investments - which is extraordinarily hard:

I like how Mike Maples at Floodgate (investors in Twitter) defines venture capital target companies: thunder lizards. Their job is to find radioactive eggs (fenomenal founders) that have the potential to mutate into monsters (great businesses) that swallow entire industries.

You have to ask yourself - is this what I’m aiming for considering constraints? Even if I am, is this my DNA? Is this the right type of financing for my business?

There are lots of wonderful business - including huge monster businesses - that don’t rely on venture capital nor other types of financing to achieve scale.

In fact, if you read Small Giants - you’ll get a good idea of how scale and success are not even necessarily the same thing, and that we should really revisit the definition of what business success really means.

3 Successful Bootstrapped Companies

Mailchimp was sold for 12 Billion to Intuit after 20 years of bootstrapping last year. They generate more than 800 million of sales per year and have more than 13 millions users.

More recently, Lemlist, after sparring with many VCs, decided to not raise funds. Out of the many reasons they mentioned: they did not perceive the VCs they met as true business partners, they were profitable almost from day one and co-founders wanted full control over the company. Lemlist hit $10M ARR milestone in 3.5 years with +20k clients.

Fleet is also a bootstrapped startup. After 3 years we reached 12m€ annualized revenue while being bootstrapped.

4 Insights From Building Fleet

Be focused on one vertical and then execute like a monster: When we launched Fleet 3 years ago we decided to only offer Macs for 2 years. Everyone kept asking us why we didn’t offer PC, Phones… We chose to focus, and it helped us master our vertical, supply, the quality of service we offer, our operations, etc. Today, the current macro environment (The war in Ukraine, the crisis of semiconductors..) has really impacted the delivery time of IT products. Thanks to our focused approached, our business has been sheltered from this impact as we benefit from our experience and quality network of suppliers.

Be Frugal: When we first launched Fleet, we were really inspired by Amazon’s values and their frugality. For many months, with a team of 5 to 6 people we did everything ourselves : Sales, Operations, HR, Marketing, Finance, product… During those times we generated hundreds of thousands of euros each month. This compelled us to be focus, disciplined and resourceful.

Leverage others networks : One of the channels that worked really well when we launched was leveraging our networks and others networks. For example we started creating perks with VCs, incubators… As those companies work with several companies by creating 1 perk with one of them you suddenly touch dozens of companies. The hack of Airbnb with Craigslist is also a well known example of a hack to leverage the networks of others.

Don’t be afraid of asking for high prices : we initially made the choice of positioning ourselves as a “premium solution”, with high prices. It was a clear choice for us. We were often tempted to decrease them, mainly to attract more clients that found us expensive. But we didn’t change them, and we made sure to deliver a quality of service that justified it. Few months later many of those clients started ordering computers because they understood the value we brought them.

Conclusion:

Business is awesome, and there’s many different ways to get to “success”.

But first, you should define what that means for you, and chose accordingly.

Right now, we’re likely (as a society) over-indexing on VC-backed ventures as our definition of “success” - let alone “how much X company raised” - and it really doesn’t need to be.

There are beautiful businesses opportunities everywhere, ready to be built!

🍬 Startup Candy

Pitching structure options:

OpenAI’s Dalle-E 2 is epic

DALL·E 2 is a new AI system that can create realistic images and art from a description in natural language. It’s still under restricted access (only for a lucky few).

A friend of mine connected me on Twitter with Javier Ideami - who was kind enough to use my prompt to try and recreate the Startup Riders logo with this AI, and its awesome:

Here’s my own (weird) attempt with geniverse:

💵 Startup Deals & Jobs

Deals

You love startups and want to enjoy a Spanish lifestyle? Come join the Spanish startup ecosystem. Here’s a list of recently funded startups:

Tinybird (big data) raised 34M

Bizaway (traveltech) raised 10M

Getlife (insuretech) raised 6M

Flaps (search) raised 5M

Nuclia (ai) raised 5M

Heura Foods (foodtech) raised 4M

Agora (marketplace) raised 2M

Singularu (ecommerce) raised 1.75M

Smowltech (edtech) raised 1.65M

Embat (fintech) raised 1.5M

Onyze (crypto) raised 1.2M

Chargy (charging) raised 1M

Aurapay (fintech) raised 500K

Flobers (fintech) raised 500K

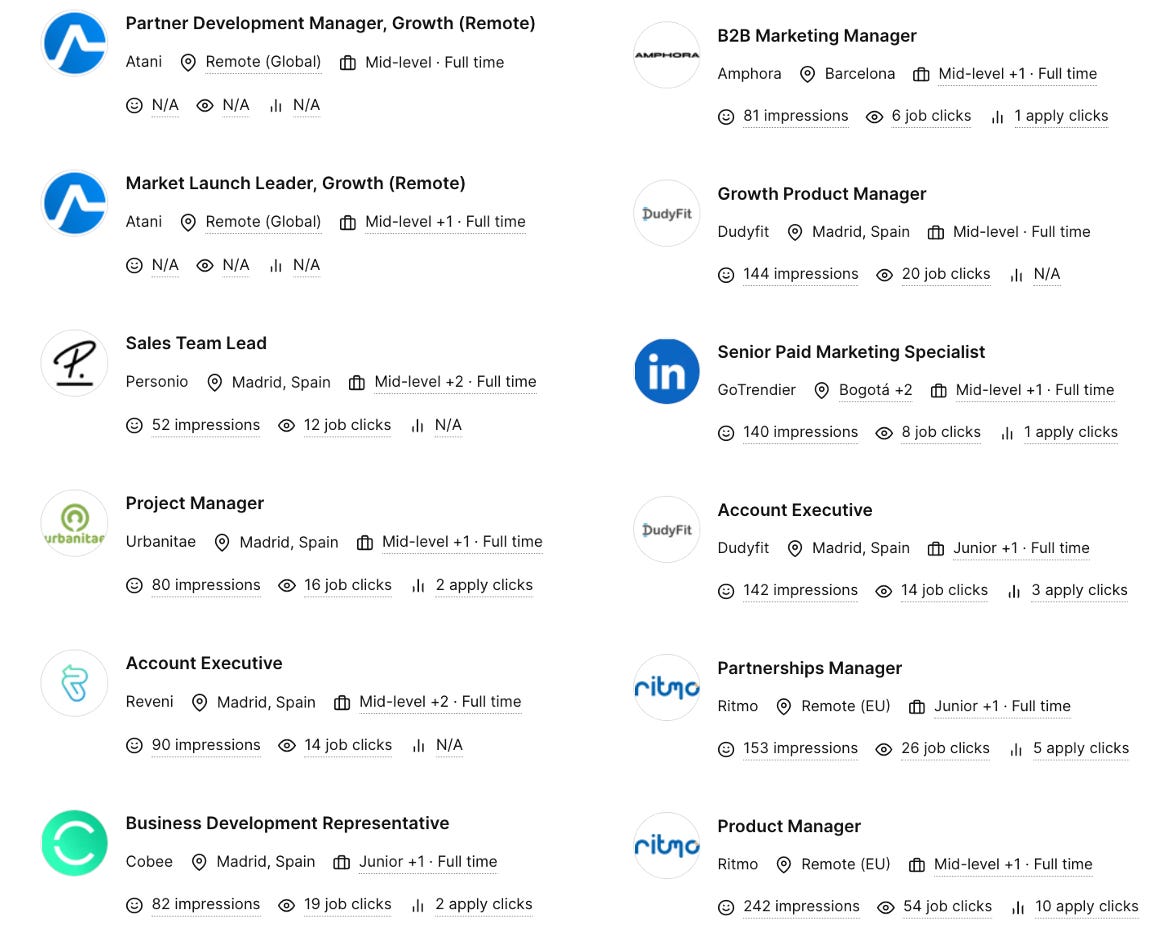

Jobs

I just launched a job board. I hand pick Growth Jobs (Product & Sales - focused on Growth) from our portfolio companies and other great startups I think would be fun, high-upside places to work. Check it out and hit me up!

What a substack! 🔥 Great job Ivan!